There’s no denying it: Singles’ Day is on the rise. Every year brings more companies, more countries, and billions more into its fold. What started as an “Anti-Valentine’s Day” and a celebration of singledom has transformed into the biggest ecommerce shopping day of the year. Here’s what you need to know about the day known as Double Eleven: its origins, its present-day stats, and the trends shaping its future.

Table of contents

- What is Singles' Day?

- When is Singles' Day?

- Who created Singles' Day?

- Singles' Day grows 10,000x in 14 years

- Singles' Day sales statistics

- Singles' Day shopping statistics

- Single's Day statistics by ecommerce platform

- Singles' Day technology & trends

- Singles' Day global statistics

- Singles' Day website issues

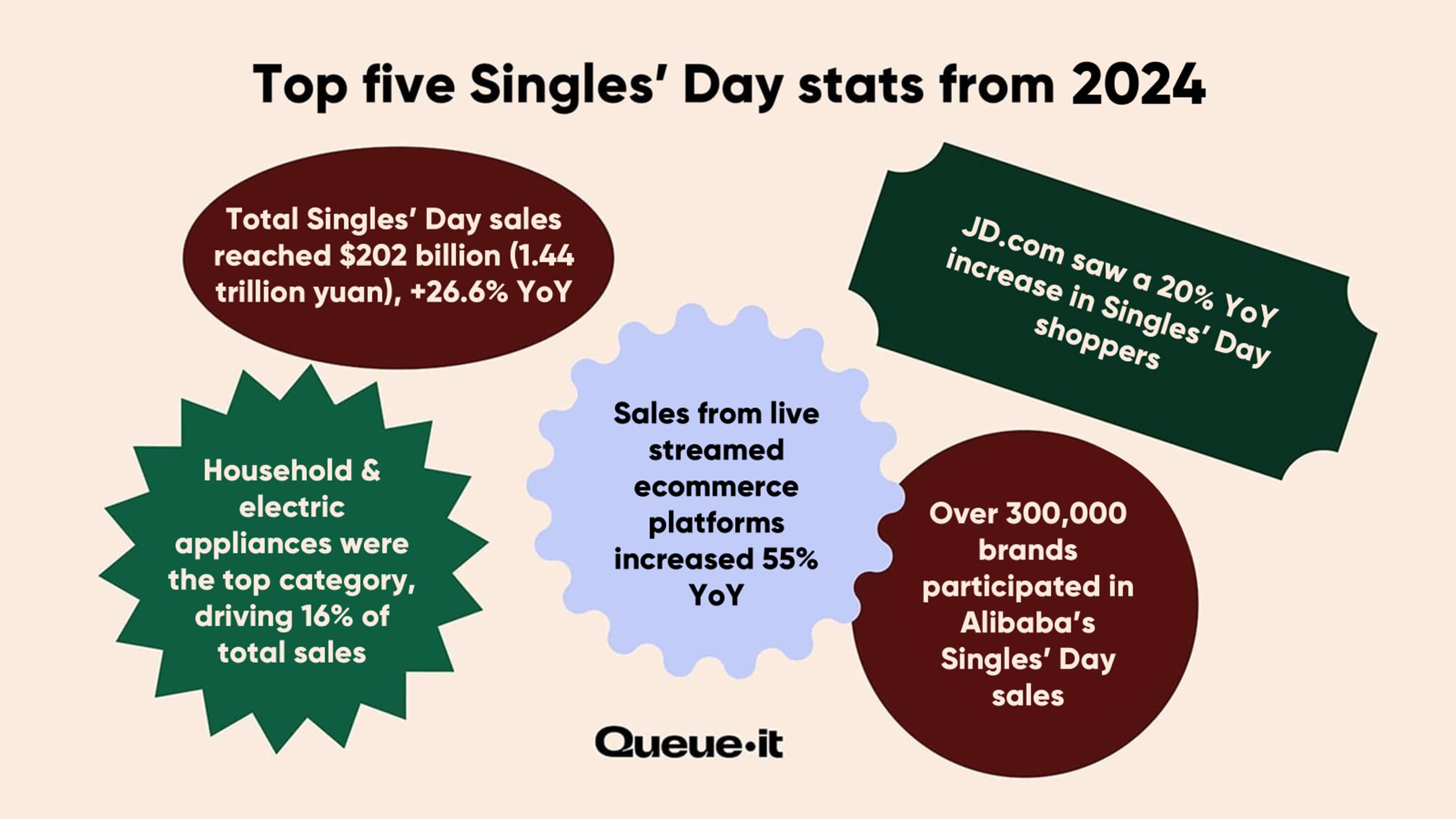

Singles’ Day is the world’s biggest shopping event, with sales estimated at $202 billion USD (1.44 trillion yuan) in 2024.

For a sense of scale, ecommerce giant Alibaba’s gross merchandise volume (GMV) during Singles’ Day 2023 was approx. $84.5 billion USD. That’s over 6 times the global GMV from Amazon’s Prime Day and almost 10x what U.S. consumers spent online across all retailers during Black Friday 2023.

Dubbed “Anti-Valentine’s Day”, Singles’ Day is a celebration of single people across China, and increasingly, the world.

RELATED: 127 Black Friday Statistics Every Retailer Needs to Know in 2024

Singles’ Day falls every year on November 11. It’s known as 11.11, Double Eleven, or “bare sticks holiday” because of how it looks numerically, consisting of four lonely ones.

But Singles’ Day has expanded in recent years, with presales now starting in late October, and promotions running through to Nov. 11.

Singles’ Day was created in 1993 by students from Nanjing University who wanted to claim their own Valentine’s Day for singles. From there, the celebrations quickly spread beyond the university, becoming widely recognized across China.

Alibaba, China's largest retailer and ecommerce company, embraced Singles’ Day in 2009. The company saw it as a chance to boost sales between China’s Golden Week national holiday (the first week of October) and Christmas.

China’s Singles’ Day sales, now officially called the 11.11 Global Shopping Festival, has skyrocketed in popularity over the last decade.

In 2009, Alibaba’s first Singles’ day sales event included 27 brands, generating a gross merchandise volume (GMV) of $7.8 million USD or 50 million yuan.

By contrast, Alibaba’s 2021 Singles’ Day GMV hit an all-time high of $84.54 billion USD. That’s up over one million percent (1,083,746%), or 10,000x in just 12 years, with an 8% increase from 2020.

2024 was the fourth year in a row Alibaba declined to release its sales data, with the company simply stating sales had experienced “robust growth” since 2023.

Alibaba rival JD.com (China’s second-largest retailer) also declined to release sales numbers in 2024, but reported a 20% year-over-year increase in shoppers.

Total ecommerce sales during Singles’ Day 2024 are estimated to be $202.8 billion USD (1.4 trillion yuan), a 26.6% increase YoY and almost 5x the amount spent online during Cyber Week in the U.S.

For the third year running, China’s big retailers declined to release their Singles’ Day revenue, so we have to rely on estimates:

- According to data provider Syntun’s estimates, ecommerce sales during Singles’ Day 2024 totaled $202.8 billion USD (1.441 trillion yuan), a 26.6% year-over-year (YoY) increase.

- Traditional ecommerce platforms contributed $154.69 billion (1.1 trillion yuan), a 20.1% increase YoY, and 77% of total sales.

- Live streaming ecommerce platforms drove $46.7 billion (332.5 billion yuan) in GMV, a 54.6% increase YoY and 23% of total sales.

- Instant retail drove $3.9 billion (28.1 billion yuan), a 19% increase YoY.

- Community group-buying platforms drove $1.9 billion (13.8 billion yuan), a 10% increase YoY.

- Household and electric appliances sales totaled $27 billion (193 billion yuan), which is 16.3% of total sales, and a 5% increase from last year—the top brands were Haier, Midea, and Xiamo.

- Mobile and electronic products sales totaled $24 billion (171 billion yuan), which is 14.4% of total sales, and a 23.1% increase from last year.

- Clothing sales totaled $23 billion (166 billion yuan), which is 14.1% of total sales, and a 21.4% increase from last year.

- Personal care and cosmetics sales totaled $13 billion (96 billion yuan), which is 8.2% of total sales, and a 22.5% increase from last year.

- Shoes and bags sales totaled $11 billion (77 billion yuan), which is 6.5% of total sales, and a 14.8% increase from last year.

- Food and beverage sales totaled $9 billion (64 billion yuan), which is 5.4% of total sales, and an 11.6% increase from last year.

- Computer and office supplies sales totaled $9 billion (63 billion yuan), which is 5.3% of total sales, and a 7.1% increase from last year.

- Furniture and building materials totaled $7 billion (48 billion yuan), which is 4.0% of total sales, and a 14.6% increase from last year.

- Maternal-infant products and toys sales totaled $6 billion (44 billion yuan), which is 3.7% of total sales, and a 12.6% increase from last year.

- Sports and outdoor sales totaled $6 billion (42.3 billion yuan), which is 3.6% of total sales, and an 18.6% increase from last year.

- China.com reported that the State Post Bureau handled 701mm parcels on Singles Day, which is a 151% increase from the usual daily average and +9.7% year over year (YoY).

-

In 2025, JD.com’s Singles’ Day sales are set to last 37 days, five longer than in 2024 and the longest in history.

-

Companies like Douyin, Xiaohongshu, and Kuaishou are also set to start their sales before ecommerce giant Alibaba.

- In 2024, Alibaba, JD.com, and Pinduoduo all launched their Singles’ Day sales periods on Monday October 14th, a full week earlier than in previous years.

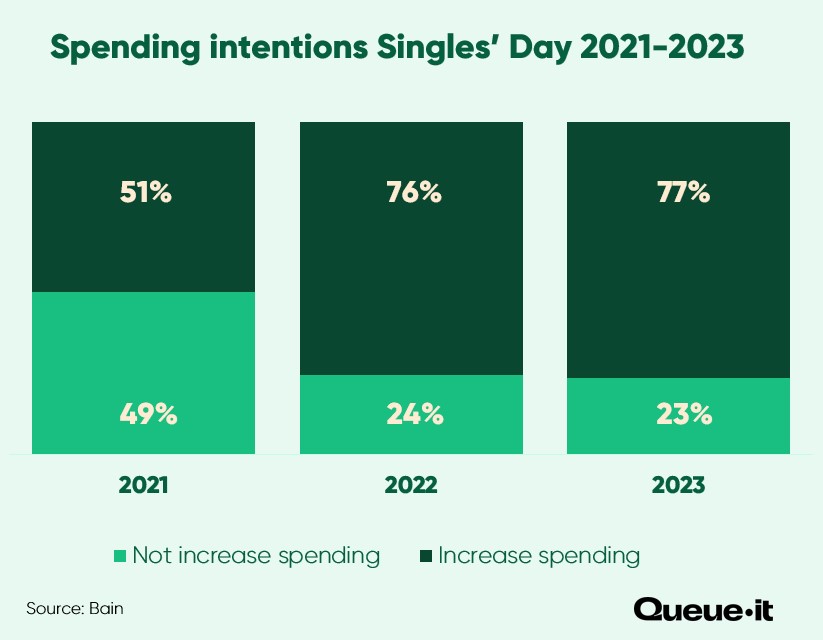

- 77% of consumers planned to spend the same amount or less during Singles’ Day 2023.

- 53% of shoppers said they were excited for Singles' Day 2023, compared with 76% back in 2021.

- 45% of consumers said they’d shop during Singles’ Day to get good value, making it the top reason to shop on the day.

- Of this group, 35% said they were waiting for better promotions to make their money go further, 18% said they were eyeing bulk deals, and 48% said they were shopping with cheaper brands or switching to generic-label products.

- China’s State Post Bureau said express delivery hit record highs during Singles’ Day 2023, with 5.26 billion packages delivered between Nov 1 and Nov 11, a 23% increase YoY.

- On 11.11 2023, 639 million parcels were delivered across China, up 16% YoY.

- 48% of respondents said they were likely to spend more during Singles’ Day 2023 than in 2022.

- Over 60% of consumers said they’ll spend at least 3,000 yuan during Singles’ Day sales in 2023, up 11% YoY.

- 83% of consumers consider “brand authenticity” as the key criteria for choosing products in 2023, followed by “product functionality” at 82%.

- Only 46% of consumers considered “livestreaming” a promotional tactic that influenced their purchase decision in 2023.

- Consumers sought products and deals across multiple channels in 2023, with the average number of channels at five, a 20% lift YoY.

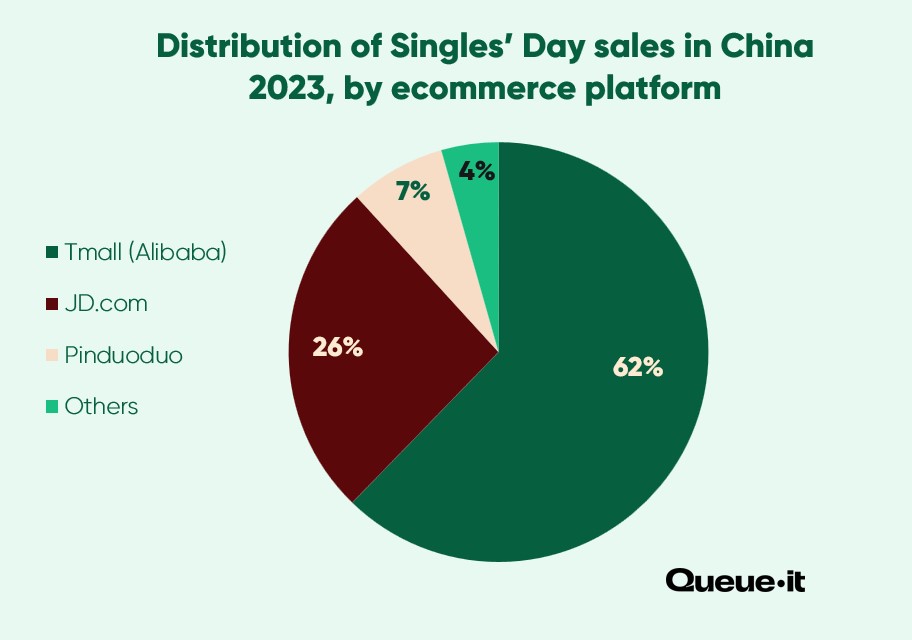

- Tmall (92%) and Jingdong (75%) remained the leading ecommerce platforms where consumers planned to shop during Singles’ Day 2023.

- 66% of consumers said they plan to increase their spending on Chinese brands in 2023, while products from all other countries and regions saw a net decrease in purchase intent.

- 73% of shoppers said they are heavily influenced by family and friend recommendations for their Singles’ Day purchase decisions.

- Alibaba/Tmall remained the top shopping destination during Singles’ Day 2024, followed by JD.com and Pinduoduo.

- 92% of consumers planned to purchase from Tmall/Taobao during 2023’s Singles' Day sales, up from 87% in 2022 and down from 94% in 2021.

- 75% of consumers planned to purchase from JD.com in 2023, up from 62% in 2022 and 67% in 2021.

- Douyin saw the biggest lift, with 55% of consumers planning to purchase from there in 2023, up from 38% in 2022 and 26% in 2021.

- Over 300,000 brands participated in Alibaba’s 2024 sales, encouraged by over $1.4 billion (10 billion yuan) spent on traffic-driving initiatives and $400 million (3 billion yuan) in marketing subsidies.

- Taobao experienced a surge in new user growth during 2024 Singles’ Day sales, with new user registrations reaching their highest point in four years.

- Alibaba’s 11.11. sales kicked off with $4.3 billion (30 billion yuan) in vouchers and subsidies.

- The Billion Yuan Subsidy Program generated over 1.5 billion orders.

- New integrations between WeChat and Taobao saw a growth of 20.9 million users within the month.

- 589 brands on Alibaba surpassed $14 million (100 billion yuan) in GMV, a massive 46.5% increase YoY, with top brands like Apple, Nike, Haier, and Xiaomi leading the way.

- 45 brands on Alibaba surpassed $140 million (1 billion yuan) in GMV.

- Members of Alibaba’s membership program (88VIPs) order volume increased by over 50% YoY.

- 88VIP members reached 42 million in 2024.

- 88VIP members visit the platform more than 25 days per month and spend 9x more than average purchasers.

- Home appliances and furniture saw sales boosted by government subsidies, with 139 brands exceeding $14 million (100 billion yuan) in GMV.

- Over 9,600 home appliances and furniture brands doubled their sales YoY.

- 79 beauty brands crossed the $14 million (100 billion yuan) GMV mark.

- 32 tech brands including Apple and Huawei crossed the $14 million (100 billion yuan) GMV mark.

- 66 fashion brands reached $14 million (100 billion yuan) in sales, with 7,062 brands doubling their sales YoY.

- Over 100 livestream rooms crossed the $14 million (100 billion yuan) GMV mark.

- 34 Sports and outdoor brands crossed the $14 million (100 billion yuan) GMV mark.

RELATED: How aCommerce & L’Oréal Deliver a Fairer Shopping Experience

L'Oréal's Singles' Day livestreams on Alibaba's Taobao

- JD.com reported more than 20% YoY growth in shoppers in 2024.

- Between October 9th and 10th, JD.com’s app users jumped 48% YoY.

- Orders from JD Live’s livestreams surged 3.8x YoY.

- Over 17,000 brand saw their transaction volume grow over five times.

- Transaction volume from 30,000+ small and medium-sized merchants on JD.com increased by 200% YoY.

- Transaction volume for 519 home and appliance categories increased by 200% YoY—including products like robot vacuums, and zero-water-pressure smart toilets.

- Sales of AI learning machines increased 10x YoY.

- Sales of cell phones, computers, and other AI-powered devices increased 100% YoY.

- AI smart glasses sales increased by 200%.

- Consumer electronics like gaming CPUs, headphones, and action cameras doubled in sales YoY.

- Outdoor gear including down jackets and children’s snow boots doubled in sales YoY.

- Transaction volume for seniors’ products increased by 140% YoY.

- JD Auto reported an increase of 95% in sales of EV charging stations and a 110% increase in installation service orders YoY.

- Participation in JD NOW, JD.com’s instant retail service, rose by over 70% YoY, with over 600,000 physical stores joining the shopping festival.

- Sales of imported Starbucks coffee beans increased 20x YoY.

- Sales of Oreo-flavored ice cream more than tripled in transaction volume.

- JD Cloud’s digital representative service drove a 40% increase in transaction volume for over 7,500 brands.

- JD.com’s intelligent customer service platform managed over 3.6 billion consultations.

- Transaction volume for interest-free installment options increased by 33% YoY.

- Transaction volume for JD Pay shopping cards rose by 84% YoY.

- Orders across electrical categories (home appliances, smartphones, computers, etc.) rose 70% YoY.

- Sales of smart robots increased 5x YoY.

- Sales of AI glasses increased 3x YoY.

Staff at JD Pharmacy fulfilling Singles' Day orders

Livestreamed shopping, also known as live commerce, has been one of the most successful sales delivery methods in China since Alibaba pioneered the trend in 2016.

Live commerce is a Singles’ Day sales staple. It combines ecommerce with entertainment through major celebrities, live giveaways, exclusive discounts, and 24-hour streaming across the whole Singles’ Day sales period.

Here are the stats:

- Four times more livestream broadcast rooms opened in the first 10 minutes of Singles’ Day 2023 than in 2022.

- The jump is largely attributed to the rise of AI livestreamers or “virtual idols” who are estimated to boost average GMV by over 30% by maximizing growth during off-peak periods and having the virtual livestreamer active 24/7.

- During Singles’ Day 2023, JD.com’s virtual influencers were active in over 4,000 live broadcast rooms.

- Major brands like Estee Lauder and L’Oreal used virtual anchors for ecommerce sales during Singles’ Day 2023.

- Taobao (Alibaba’s livestream platform) recorded 684% YoY growth in pre-sale volumes generated by new livestreaming hosts in the first four hours of pre-sales.

- $11.8 billion USD (73.8 billion yuan) was spent on live commerce platforms during 2021 Singles’ Day sales.

- Li Jiaqi, dubbed the “Lipstick King” is rumored to have driven almost sales of over $3.4 billion in 2023.

- 11% of Chinese consumers planned to participate in Singles’ Day just to watch the livestreams in 2021.

- 88% of respondents from first-tier cities planned on spending via livestream shopping during Singles’ Day sales in 2021. For comparison, 79% of respondents from tier-3 and tier-4 cities planned to use livestreamed shopping.

- One 2022 survey found 77% of Chinese shoppers have purchased products using live commerce. For comparison, just 22% of Australian shoppers have used live commerce.

- Users of live commerce spent an average of 9 minutes per day on Taobao across Singles’ Day sales in 2021, compared to 28.3 minutes for non-users.

- Benedict Cumberbatch participated in 2021’s Singles’ Day livestreams to give clues about a mystery box. He joins Singles’ Day Western celebrity livestream alumni Katy Perry, Kim Kardashian, Miranda Kerr, and Taylor Swift.

- Alibaba released it’s AI-powered customer service chatbot Xiaomi ahead of Singles’ Day 2023, providing more personalized and accurate answers to customer inquiries than traditional chatbots.

- Alibaba’s Taobao also debuted a virtual try-on feature, allowing customers to visualize how clothing products would look in real life, including how clothes would stretch, cling, and fold on their bodies.

- Taobao’s virtual try-on feature is available for clothes from over 3,500 merchants on Taobao and has been used by over 500,000 users.

Taobao’s virtual try-on feature is available for clothes from over 3,500 merchants on Taobao and has been used by over 500,000 users.

- Brands and retailers also used another AI-based tool called Energy Expert during 11.11 to cut their carbon footprint and certify their carbon-reduction efforts to help consumers make more informed choices.

- For example, U.S. sports brand Brooks Sports reduced the carbon emissions of its running shoe collection Ghost 15 by 1 kg per pair by using recycled materials, and this process was certified by Energy Expert.

- Swedish food company Oatly also tapped Energy Expert during Singles’ Day to certify the low carbon footprint of its raincoat.

- In 2024, Alibaba launched Marco MT, an AI-powered translation tool supporting 15 languages, to help brands translate their ecommerce content automatically.

- Virtual influencer Ayayi has over one million social media followers.

- Ayayi has partnered with over 30 high-end brands, including Louis Vuitton, Burberry, Porsche, and Prada, for marketing campaigns in China.

- Ayayis’ male counterpart Noah was created based on the votes of over 21,000 Chinese consumers, who chose his personality, skills, and appearance. This resulted, Alibaba says “in a cool male model with dark hair who can dance like a K-pop star”.

- Noah ran a livestream for Tommy Hilfiger, in 2022 where he spent over an hour chatting to customers and dancing. The livestream was viewed by 670,000 people and the brand's GMV from livestreams during the hour quadrupled.

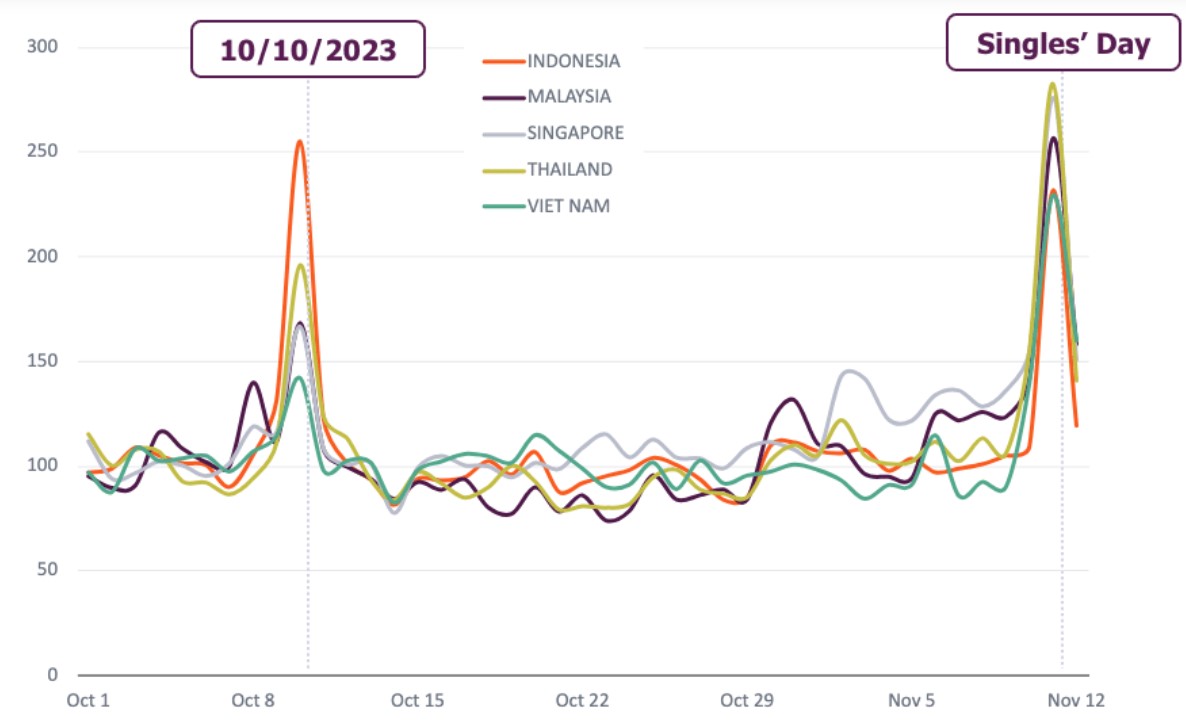

The Southeast Asian and Chinese markets have been ripe for a shopping celebration like Singles’ Day for several reasons. The population is growing, the middle class is emerging with an increasing disposable income, and affordable smart phones are accessible throughout the region.

- Online retail transactions spiked 140% on Singles’ Day 2023 compared to the first week of October in Southeast Asia.

- In Thailand, sales increased 182% month-over-month (MoM) during Singles’ Day sales 2023.

- In Singapore, sales increased 176% MoM during Singles’ Day sales 2023.

- In Malaysia, sales increased 156% MoM during Singles' Day sales 2023.

- In Indonesia, sales increased 131% MoM during Singles’ Day sales 2023.

- In Vietnam, sales increased 129% MoM during Singles' Day sales 2023.

Indexed transactions from Southeast Asian 2023 (Source: Criteo)

Is there potential for Singles’ Day shopping celebrations to be incorporated into Holiday Season sales outside Asia?

Many signs point to yes.

More and more European ecommerce companies are merging Singles’ Day into their end of the year sales, both in China and in their home markets.

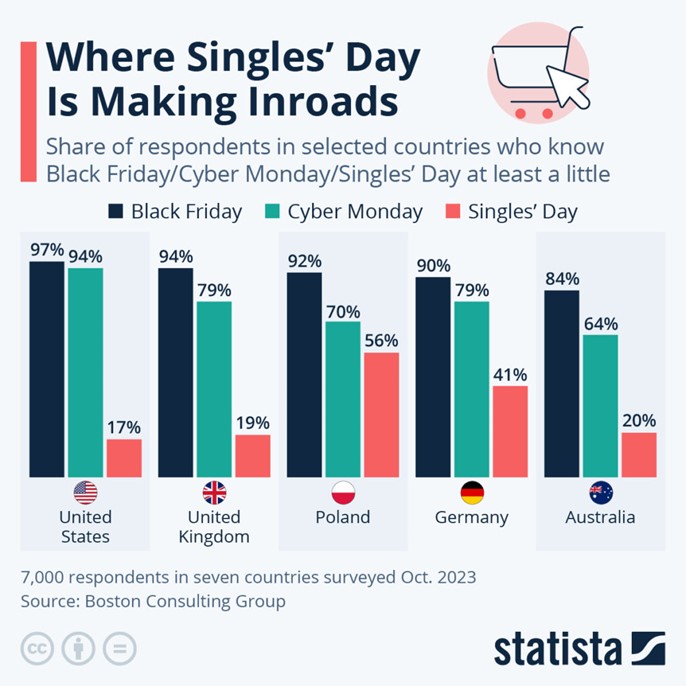

- 69% of U.S. consumers had never head of Singles’ Day in November 2024.

- Awareness of Singles’ Day in the U.S. reached 17% in 2023.

- Awareness of Singles’ Day in the U.K. reached 19% in 2023.

- In Poland, awareness of Singles’ Day reached 56% in 2023.

- In Germany, awareness of Singles’ Day reached 41% in 2023.

- In Australia, 20% of respondents were aware of Singles’ Day in 2023.

- In 2023, nearly a quarter of respondents across the globe said they’re at least somewhat aware of what Singles’ Day.

- The German-based Media Markt, one of Europe’s largest consumer electronics retailers now promotes Singles’ Day at their stores. They ensure their discounts are “nicht nur für Singles” (not just for Singles).

- The biggest Dutch ecommerce site, bol.com, began participating in Singles’ Day in 2017, which proved to be the year’s busiest Saturday. In 2020, the business expanded their Singles’ Day sales into a three-day event.

- A Vogue article on Singles’ Day says Western brands Luisa Via Roma, Verishop, and By Far, run major Singles’ Day sales in Europe and the U.S.

Singles’ Day shatters sales records and draws in more shoppers every year. And the steady growth of ecommerce, mcommerce, and the Asia-Pacific market is only projected to continue.

But more traffic brings with it more website slowdowns and crashes.

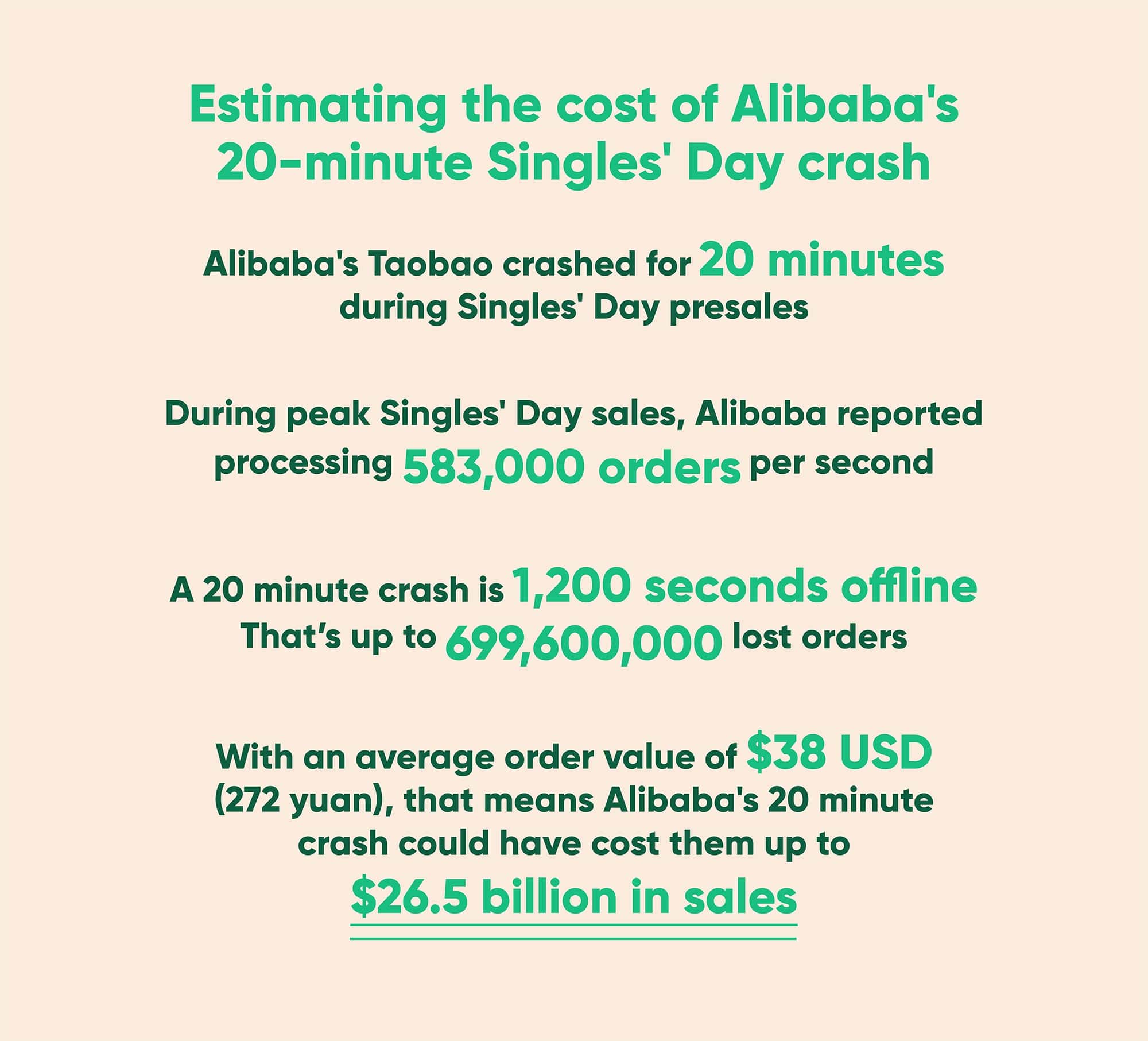

In 2021, Chinese shoppers flocked to the first Singles’ Day livestream pre-order event, crashing Taobao for 20 minutes.

The hashtag “Taobao crashed” was the number two trending topic on Wiebo, China’s version of Twitter. The topic thread had almost 18,000 comments, with many users complaining about missing out on deals and not finishing their orders.

The costs of website crashes add up fast, both for reputation and revenue.

In 2020, Alibaba reported up to 583,000 orders per second during peak periods.

A 20-minute crash is 1,200 seconds offline.

That’s up to 699,600,000 (almost 700 million) lost orders.

With an average order value of $38 USD (272 yuan), that means Alibaba's 20 minute crash could have cost them up to $26.5 billion in sales.

Related: The Cost of Downtime: IT Outages, Brownouts, and Your Bottom Line

This isn’t the first year Singles’ Day has crashed sites. In 2018 the ecommerce website Momo also saw traffic reach a new high with over 700 million transactions. At one point, the website crashed for 20 minutes because of traffic overload.

On the year’s biggest ecommerce shopping day, even a minute of website downtime can result in staggering sales losses. Even minimal slowdown or downtime can have a lasting effect on brand reputation.

With billions on the line, are you doing what it takes to safeguard your website?