How SB Payment Service handles over 5x system capacity without scaling

As one of Japan’s largest payment service providers within the SoftBank Group, SB Payment Service sits at the center of countless online transactions. With growth has come a new challenge: supporting major merchants whose high-profile events trigger massive traffic spikes. This case explores how the team adopted Queue-it’s virtual waiting room to handle extreme demand while keeping costs in check and customers satisfied.

80%

savings on scaling

compared to estimated cost of ¥100 million

5x

increase in traffic handled

compared to the usual system capacity

SB Payment Service, a SoftBank Group company, is one of Japan’s largest payment service providers and payment aggregators. The company supports a wide range of customers across industries with online and in-store payment solutions, including SoftBank’s carrier billing service, “SoftBank Collective Payment”, and the VISA-branded “SoftBank Card”.

At the core of SB Payment Service’s digital infrastructure is its System Operation Control Team, which is responsible for everything from development platform provisioning to operations and monitoring efficiency. Their work spans DevOps, SRE, and platform engineering.

As adoption of SB Payment Service grows, the company has taken on more high-profile merchants that drive extreme spikes in activity, straining systems during popular events and campaigns. It’s the System Operation Control Team’s responsibility to ensure stable, reliable service during these peak moments. Discover how the team uses Queue-it’s virtual waiting room to control extreme traffic, optimize costs, and improve the customer experience.

“Payment systems function like social infrastructure—they’re expected to work flawlessly, and users rarely express gratitude,” says Section Chief, Daichi Kimura. “But when we invested in traffic-burst control mechanisms like Queue-it, we saw comments on social media, such as ‘I was finally able to buy smoothly.’ It reminds us that our work supports the user experience.”

SB Payment Service faces traffic peaks triggered by various events and campaigns—for example, the release of popular plastic model kits, launch of artist fan clubs, hometown tax (furusato nozei) donations, and restaurant chains’ Christmas gift card sales.

Among these, fan club launches drive the most severe and concentrated surges in traffic. Before implementing Queue-it, these activity spikes from one merchant often impacted SB Payment Service’s entire platform, destabilizing it for several hours. Fan club launches attract highly enthusiastic users, so frustration and disappointment ran high.

Like many payment providers in Japan, SB Payment Service operates many of its core systems in on-premises environments for security and compliance reasons. While essential in a tightly regulated sector, these architectures are challenging and expensive to scale—especially for temporary, extreme activity surges.

“We implemented rate controls on the load balancer, but the incoming traffic far exceeded the system’s performance limits and became impossible to control. As a result, the entire service became unstable,” Kimura recalls.

He adds, “Payment services are directly tied to our merchants’ business trust. We risked disappointing users who were genuinely looking forward to these sales and campaigns. That’s why finding a solution became an urgent mission.”

This experience led to a key realization for Kimura’s team: “Without control over traffic, the system could not be protected.” That insight ultimately led them to Queue-it.

Having tried solutions such as load balancing and rate limiting, Kimura knew the team needed a solution that gave them full control over both cost and customer experience.

“I’ve known of Queue-it since it first started offering services in Japan,” Kimura says. “Over time, I saw more and more brands adopting it and recognized its strong reputation.”

“The virtual waiting room solution makes a lot of sense. It’s unrealistic to invest in infrastructure for unpredictable peaks—both from a cost and operational efficiency standpoint. And when you rely on downstream, third-party services such as credit card companies, capacity expansion isn’t something you can fully control.”

Daichi Kimura, Section Chief at System Operation Control Team

“Given these constraints, controlling traffic at the entry point with Queue-it was the smartest choice to efficiently protect our service and systems without compromising user experience,” says Kimura.

The System Operation Control Team worked with Queue-it to implement the virtual waiting room in 24/7 Peak Protected mode. This waiting room type allows them to deliver an uninterrupted user experience during normal operations, automatically triggering protection only for specific events, when traffic exceeds the thresholds they set. With this setup, most visitors never see the waiting room, and one merchant’s peak traffic doesn’t disrupt others using the platform.

For their first fan club launch with Queue-it, the SB Payment Service team had the 24/7 Peak Protected waiting room configured at the entry point of the payment gateway. The waiting room was set up to only trigger for visitors arriving from the fan club launch, ensuring no other merchants or consumers were impacted by the activity surge.

When the offering launched, thousands of fans poured in and the waiting room activated within seconds, controlling the flow of traffic to SB Payment Service’s systems. All visitors attempting payment were shown detailed wait information, then redirected in a fair, first-in, first-out order to the payment page when their turn arrived.

SB Payment Service's queue page

“Previously, when traffic exceeded our thresholds, the only option was to display a ’sorry page’ and ask users to try again,” Kimura recalls. “We felt pressured because we knew it was a major disruption for both users and merchants.”

With Queue-it, SB Payment Service managed to process more than five times its usual system capacity without any infrastructure scaling.

“Scaling our systems would have required upgrades across multiple areas, including servers, databases, network infrastructure, and connections to payment providers. We estimated that this would have meant an additional investment of at least ¥100 million. By implementing Queue-it, we were able to reduce costs by approximately 80% compared to that level of investment.”

Daichi Kimura, Section Chief at System Operation Control Team

Kimura noticed the waiting room drastically improved the user experience, too.

“Before, many fans believed they needed to keep refreshing to get access. They would get frustrated by error screens or slow responses. But after introducing Queue-it, we noticed the waiting room turned waiting into something positive. We even saw posts on X saying, ‘I can’t wait to pay!’ As long as they see a proper waiting room page with a deliberate, informed experience, they wait calmly—and even enjoy it. That was fascinating to see.”

He also added that Queue-it improved the team’s work efficiency and the perception of traffic peaks. "Previously, we had to maintain an extensive monitoring setup to prepare for worst-case scenarios at all times," he recounts.

“With Queue-it providing stable and reliable traffic control, we were able to optimize our operational setup and significantly reduce the psychological burden on our team. As a result, we can now reinvest the operational capacity we’ve freed up into higher-value initiatives, such as service improvements and long-term infrastructure planning.”

Daichi Kimura, Section Chief at System Operation Control Team

“We used to feel that we had to be ready to handle every single incoming request at all times. Now, we’ve shifted our mindset: as long as traffic is processed steadily within an acceptable waiting time, that’s sufficient. This change in perspective has been a major relief for our team.”

Beyond fan club launches, SB Payment Service also uses Queue-it for online charity donations tied to TV programs. As a result, there is increasing internal demand to offer Queue-it to more merchants.

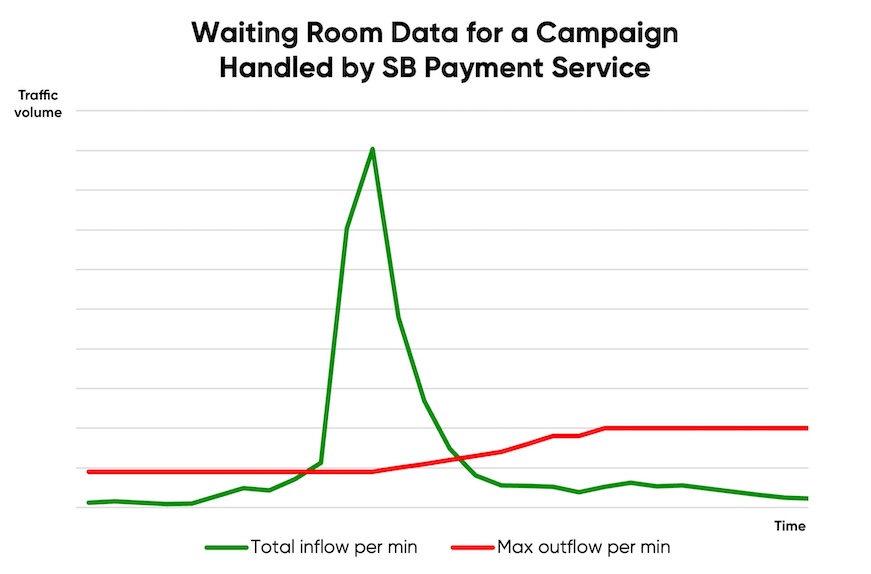

Chart showing large sudden traffic spikes during a campaign SB Payment Service handled

While Queue-it solved SB Payment Service’s major traffic peak issues through entry-point control, Kimura emphasizes that their journey continues.

“Many payment systems companies spend a lot of time and money striving for real-time, zero-wait processing—sometimes at the expense of a reliable experience. But working with Queue-it has shown us that reliability is more important than speed, and that customers are willing to wait.”

He also had a message for others facing similar challenges: “Let’s spread the use of virtual waiting rooms, shift the industry mindset around waiting, and build a world where system teams don’t burn out over capacity management.”

“We want to redefine the value of waiting time and continue building an even stronger foundation for growth. We’ll keep supporting the core of our service and delivering value to both users and merchants.”