How financial institutions avoid website crashes & stay compliant with Queue-it

Learn how financial institutions and insurers use Queue-it to prevent website crashes, ensure uptime, and meet digital compliance standards like DORA and CPS 230.

In today's digital-first world, banks and insurance companies can’t afford to have their services go offline, especially during peak demand. Whether it’s a surge in claims after a disaster, customers rushing to access funds, or a new product launch that draws thousands, your digital services need to perform.

A single outage can lead to frustrated customers, missed transactions, and a loss of trust. It can also bring unwanted attention from regulators who increasingly demand that financial services maintain operational resilience.

Discover why major financial institutions are using virtual waiting rooms to handle demand during surging traffic, how these solutions work, and how they can help you stay compliant with global regulations like DORA, MAS TRM, and CPS 230.

Downtime can occur for many reasons—system updates, third-party failures, human error. But one of the most common, and damaging, drivers of downtime is surges in traffic. It strikes when demand is highest, visibility is greatest, and expectations are at their peak. Whether it’s payday, a product launch, or a surge in claims, a crash at the wrong moment does more than frustrate users, it puts your reputation and business at risk.

Customers depend on you for time-sensitive, critical services. Whether they’re transferring money, submitting a claim, or accessing investment accounts, they expect reliable, secure access. If your service goes offline, you risk:

- Damaging customer trust

- Overwhelming support teams

- Making headlines for the wrong reasons

- Financial penalties

Earlier this year, for example, one of the UK’s largest banks experienced a major outage that took down its online and mobile banking services. The timing couldn’t have been worse; it happened on both payday and the tax return deadline, leaving millions of customers unable to access their accounts. Customers reported issues such as delayed payments, inaccessible funds, and outdated balance information.

The disruption quickly spread beyond the bank’s systems, sparking a wave of frustration on social media. Many customers publicly questioned the bank, with some even vowing to switch banks altogether. While regulators chose not to impose a financial penalty, the bank still faced a significant cost, reportedly between £5 million and £7.5 million in compensation paid out to affected customers.

RELATED: The Cost of Downtime: IT Outages, Brownouts & Your Bottom Line

This incident highlights how digital downtime can have far-reaching impacts, not just on operations and revenue, but on customer confidence and brand reputation.

Examples of headlines reporting outages & crashes at financial institutions

As we’ve seen, even the most robust systems can falter under peak load. That’s why many financial institutions use a virtual waiting room, to help control the flow of traffic to their websites and applications, ensuring stability and fairness during peak periods. By managing visitor flow before it reaches your infrastructure, Queue-it's virtual waiting room enables you to:

- Ensure website performance: The virtual waiting room captures sudden surges in web traffic before they hit your site and allows you to control the rate at which visitors get access, ensuring you never exceed the technical capacity of your systems.

- Improve citizen experience: Virtual waiting rooms replace the frustrating experience of a website crash or slowdown with transparent and controlled access, including detailed wait information on a branded page that can feature important info like registration deadlines and necessary documentation.

- Deliver fair access: Virtual waiting rooms provide sophisticated fairness mechanisms by ensuring first-come-first-served site access and allowing visitors to get notified when it’s their turn.

Virtual waiting rooms provide 24/7 protection by continuously monitoring traffic to your site, key landing pages, or services like logins. When incoming visitor volumes exceed your set threshold, the waiting room activates automatically to control traffic flow.

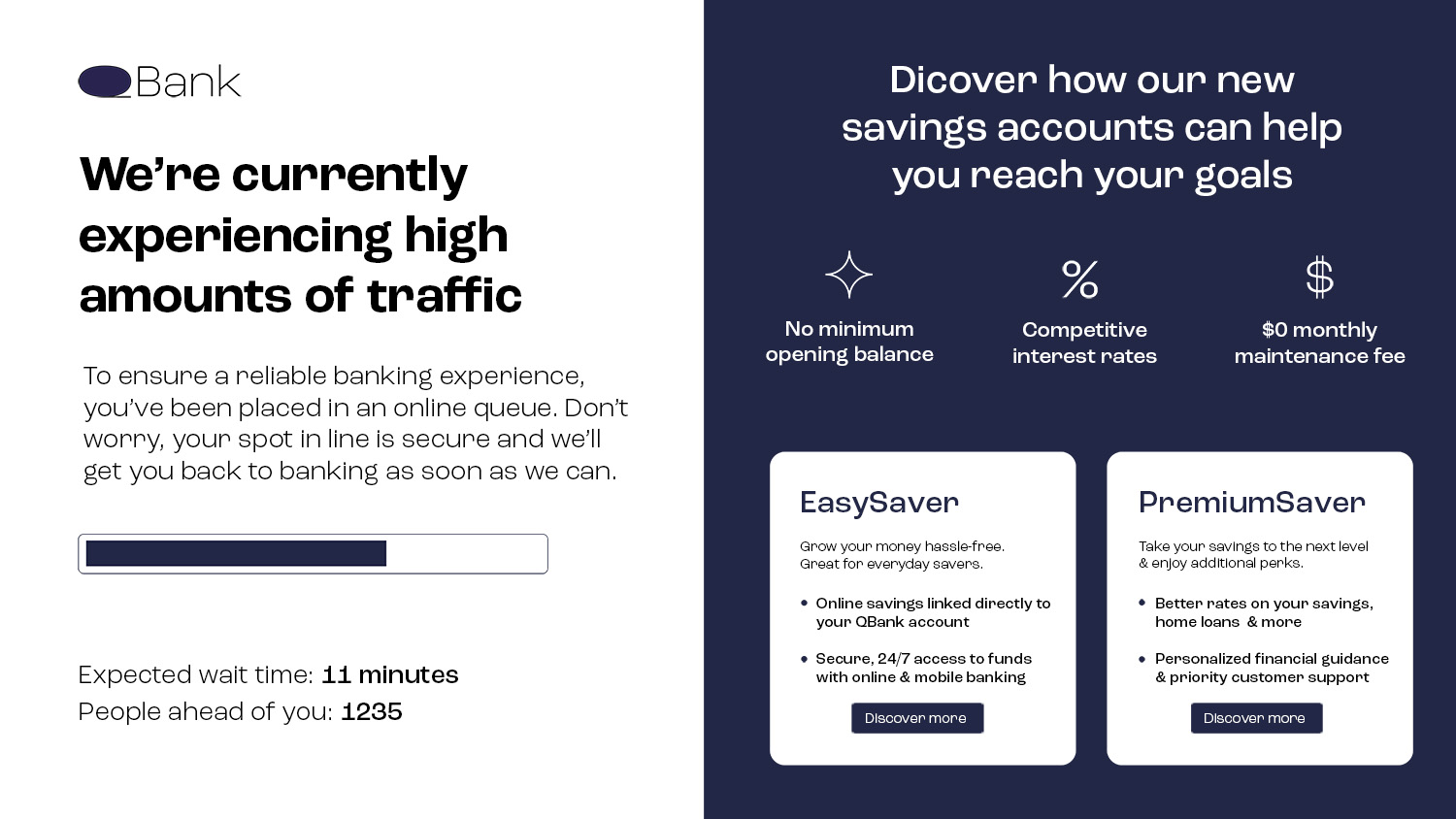

Visitors get seamlessly flowed to a branded waiting room like the one below, where they see their number in line, their estimated wait time, and a progress bar. They experience a short, informed wait, then are flowed back to your site at the rate it can handle in a fair, controlled order.

Example of a financial institution virtual waiting room page

While organizations often customize their waiting rooms both in style and in URL to look like the original site, the visitors in them are hosted on the virtual waiting room provider’s servers. This means no strain is placed on the target website’s servers while visitors wait for access.

Controlling the flow of traffic not only keeps your site online, it can also save you time and money. In a recent survey, Queue-it customers reported a 38% decrease in server scaling costs and a 51% decrease in the number of staff needed on-call during registrations.

RELATED: Queue-it Customer Survey: Real Virtual Waiting Room Results From Real Customers

The need for stability touches every part of the financial ecosystem. Here’s how financial institutions use Queue-it:

Guard against member login spikes:

- A Danish insurance company uses Queue-it’s 24/7 protection on its member login page to guard against expected and unexpected traffic spikes

Protect mobile apps during marketing campaigns:

- A British investment bank uses Queue-it to ensure its app remains reliable during monthly campaigns where they reward customers with prizes

Ensure a smooth customer experience:

- A Japanese bank uses Queue-it during promotional campaigns to protect its app against overload and ensure a smooth experience for customers

Get peace of mind on mission-critical days:

- A Hong Kong insurance company uses Queue-it as a peak protection tool when running large marketing campaigns in collaboration with other brands

RELATED: Queue-it For Financial Services: Deliver Reliable Access, No Matter The Demand

Around the world, financial regulators are raising the bar on operational resilience. Institutions are now required to show they can maintain service continuity, even during peak demand, cyber incidents, or infrastructure stress.

Queue-it helps you meet these expectations by preventing downtime, improving digital reliability, and aligning with major regulatory frameworks.

In the European Union, the Digital Operational Resilience Act (DORA) requires financial firms to prove they can withstand and recover from IT disruptions. It’s a response to increasing reliance on digital infrastructure and applies to a wide range of financial entities. Queue-it supports DORA compliance by managing access during peak load, helping ensure service continuity and uptime.

In many regions, legislation like the Protection of Critical Infrastructures Bill places financial and insurance services in the category of essential digital infrastructure. That means you’re expected to minimize operational risk and guarantee service availability, even under stress. Queue-it reduces the risk of system overload during key events, helping protect these vital services.

And in Australia, the Australian Prudential Regulation Authority (APRA) introduced CPS 230, which focuses on operational risk management for banks, insurers, and superannuation funds. Institutions must identify and manage digital risks that could disrupt service. Queue-it helps mitigate one of the most common risks: website failure during high-traffic periods, so you can stay aligned with CPS 230 requirements.

With Queue-it, you can:

- Maintain uptime and continuity during high-demand events

- Meet expectations for digital availability and resilience

- Show proactive risk mitigation in your compliance efforts

Customers expect you to be available when it counts. Regulators expect you to be prepared. A crash at the wrong moment can shake confidence in both.

With Queue-it, you don’t have to gamble with performance or compliance. You can keep your systems running, meet regulatory demands, and protect the trust you’ve worked hard to earn.