NFTs have disrupted the digital world and industries from art to gaming to investing. But non-fungible tokens are yet to see their full potential. Twitter, Meta, and Reddit are all working on NFT projects, investors are betting big on NFTs, and new NFT startups are cropping up every day. So what does the future of NFTs look like? What industries will they disrupt next? And what NFT trends will define the years to come?

NFTs took 2022 by storm. With billions traded over non-fungible tokens and a strong community behind the technology, we’re seeing NFTs be adopted by industries as diverse as gaming, finance, art, and medicine.

Don’t know what NFTs are? Check out our NFTs explained blog post for all you need to know.

The potential applications of NFTs are near endless. Some claim ten years from now all purchases will be accompanied by NFTs. Others think smart contracts will replace legal documents. And while many think NFTs are a fad or too niche to become widely used, big players from Meta (formerly Facebook) to Twitter to Reddit to Visa are taking notice and are working to ensure they don’t miss out on the NFT boom.

But what is the future of NFTs? What are the latest NFT trends and applications? And what new NFT trends will we see in 2023 and beyond?

We've scoured the web and gathered together the latest and upcoming trends in:

1. NFT Gaming

In 2017, a new video game allowing users to collect, breed, and sell NFT kittens skyrocketed in users. CryptoKitties was so popular the transaction volume exceeded the bottlenecks of the Ethereum network, slowing transactions of the cryptocurrency down.

Fast-forward to 2023, and there are now hundreds of games built entirely around NFTs. NFTs are being integrated into existing games. And NFTs are even showing potential for changing the way in-game marketplaces operate.

Play-to-earn gaming

Blockchain technology and NFTs have massive potential for the gaming industry. And games like Axie Infinity and Blankos Block Party are making waves with play-to-earn (P2E) models which are making gamers real money. They’ve exploded in popularity over the past year—particularly in developing countries—because who doesn’t want to make money playing video games?

Axie Infinity is probably the most popular P2E game out there. Inspired by Pokémon, the game is based on buying, breeding, and training Axies to send into battle. The Axies themselves are NFTs, and through battles players can earn Smooth Love Potion, a cryptocurrency which can be sold on a secondary market for real money. With over $1 billion traded on the Axie platform, it’s one of the most valuable NFT projects in the world.

RELATED: 39 NFT Ideas & Examples: The Wild, the Weird & the Wonderful

The Metaverse

But the trend really shaking up the world of gaming goes beyond play-to-earn, and it has implications far beyond traditional gaming: the metaverse.

If you haven’t heard about the metaverse, it’s essentially a digitally shared space which combines virtual and physical reality.

Many are touting the metaverse as the future of online interactions and the next stage for the internet. Mark Zuckerberg recently announced Facebook’s change of name to Meta, and the company’s intention to become “a metaverse company“. Meta plans to become a virtual space combining the realms of work, entertainment, and social interaction.

What does this have to do with NFTs?

Well, in Zuckerberg’s announcement, he stated that privacy, safety, and interoperability need to be built into the metaverse. The more our lives move online, the more we’ll need secure ways to prove ownership of our identities and digital assets.

This is where NFTs come in.

Think of the metaverse like the real world, only digital. You can interact with others, explore, go shopping, and complete challenges. What NFTs enable in this space is the same non-fungibility of assets we see in the real world.

What drives the value of assets is scarcity and utility. And NFTs allow creators to introduce both scarcity and utility into the metaverse, meaning a unique economic system can grow within it.

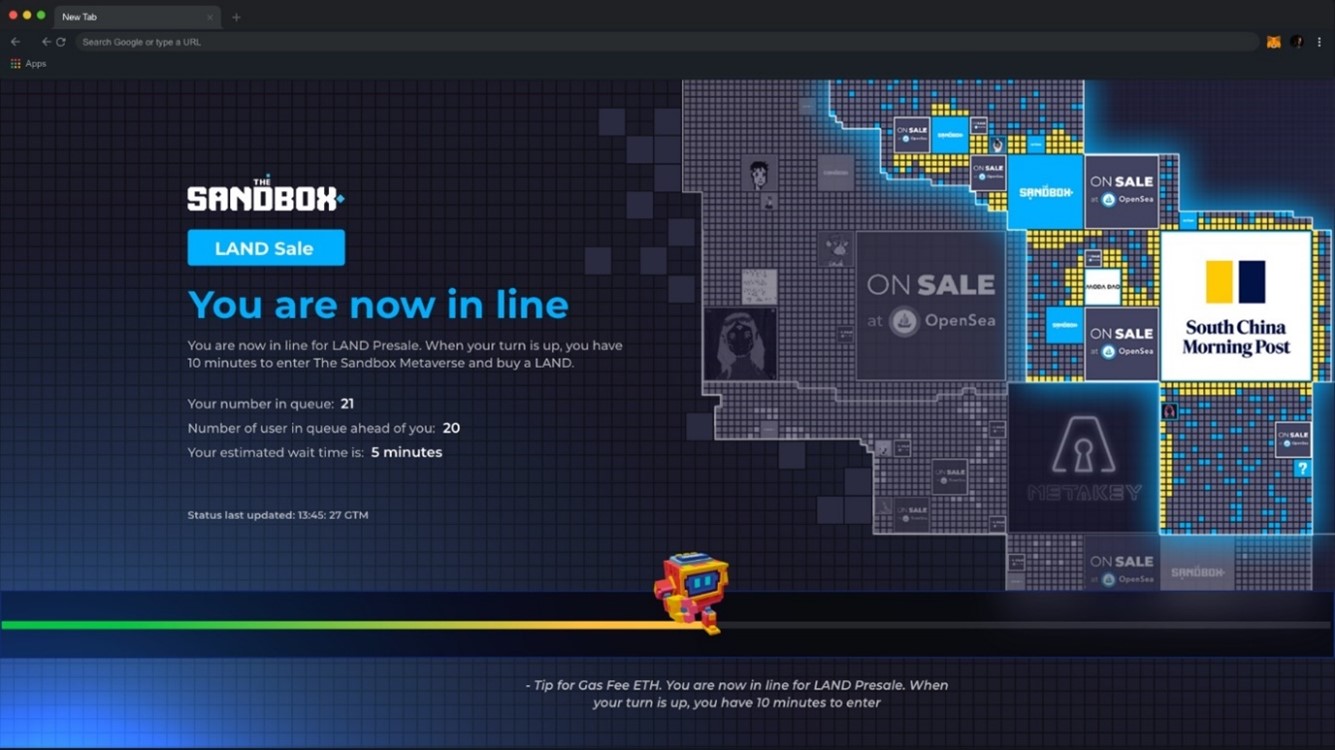

Leading metaverse companies Decentraland and Sandbox are using NFTs for precisely this, tokenizing everything from usernames to in-game wearables to real estate. And by the looks of it, Twitter and Facebook (Meta) are planning to follow suit.

Take real estate, for example. In Decentraland, real estate is limited and ownable as an NFT. Just like the real world, the land you buy in Decentraland belongs to you. You can do what you like with it: build a home, a business, an art gallery, or display advertisements.

And just like in the real world, your land is valuable not just because of its utility for you, but because of its scarcity and potential utility to other people. This means the more interest in an area, the more valuable property in that area becomes. Things like location, square footage, and market trends affect the value of properties. And because you own the property as an NFT, you can sell it at a profit and transfer ownership to someone else.

That’s why Every Realm spent almost $1 million on a large plot of land on Decentraland—it was a busy area and they wanted to capitalize on the in-game foot traffic to build a virtual mall. They are now leasing out stores within that block of land, which they named the Metajuku Shopping District.

Transforming in-game marketplaces

What’s interesting about NFT-based games is they represent an alternative to the current system for gaming marketplaces, where around $50 billion is spent annually on in-game purchases.

The current system typically limits in-game purchases to one game and one user, making them essentially worthless once the user becomes disinterested in the game. By turning these in-game items into NFTs, they have value on a secondary marketplace, and could be transferable to other games.

With scarcity, transferability, and proof of ownership, gamers can see their in-game purchases as an investment with potential for future returns, rather than just a fun addition to regular gameplay.

RELATED: 9 Steps for a Successful NFT Drop: Hype, Fairness & Fun

2. NFT Ticketing

GET Protocol and Centaurify are among several companies ushering NFTs into the world of ticketing. The creation of tickets as NFTs gives more control over the resale market, more secure storage of tickets, and the opportunity for tickets to be viewed as digital collectibles.

Queue-it's CEO and co-founder Niels Henrik Sodemann recently told Ticketing Business News:

“We believe that one of the biggest changes we’ll see in the industry over the next five years is the increase of digital components in the ticketing revenue stream. A great example of that is the combination of ticketing sales with NFTs.

"The value created for customers would be two-fold: getting to attend the live entertainment experience itself, and an exclusive and personal digital asset.

"Gone are the days of autograph albums and t-shirt tables. With concerts, you could imagine the allure of trying to hold on to that experience once it’s over by either possessing the video of your favorite song, a personal signature from the artist, or a unique artist/tour/city commemorative.”

And NFT ticketing goes beyond this. The future of NFTs in ticketing offer opportunities for lifetime value, exclusive access, and extra incentives for buyers. A few innovative applications of NFT ticketing include:

- Kings of Leon selling NFTs that entitle buyers to lifetime front row seats at their tours

-

WarnerMedia’s DC Comics giving out comic book NFTs along with tickets to their DC FanDome event

-

Gary Vee’s Vee Friends NFTs, which double as exclusive tickets to 3 years of the conference VeeCon

-

Mark Cuban’s announcement he wants to bring NFT ticketing to the NBA

-

An NFT of Andy Murray’s Wimbledon 2013 win, which included two VIP tour experiences and Centre Court tickets to Wimbledon Gentlemen’s Final 2022, as well as a 30 minute game of tennis with Murray himself

-

Coinbase’s integration of NFT merchandise into the Governors Ball Music Festival in New York, giving its users a free, one-of-a-kind NFT which also granted access to the VIP lounge

This festival attendee walked away from The Governors Ball with a free fanny pack and and an NFT

3. Avatars & PFP NFTs

Profile picture (PFP) and avatar NFT projects are among the most successful in the history of NFTs. The stage for these projects was set in 2017 with the release of the now infamous CryptoPunks.

10,000 CryptoPunk NFTs were algorithmically generated and given away for free in 2017 to any interested party with an ETH wallet. Fast-forward to 2023, and over $4 billion has traded hands over the NFT series.

Today you can spot CryptoPunks on Jay-Z, Visa, Snoop Dogg, and Odell Beckham Jr.’s Twitter pages, and even on the red carpet at the Met Gala.

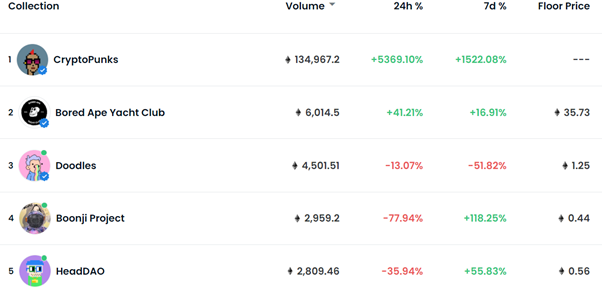

A quick look at OpenSea’s most valuable NFT series shows that avatars and PFP NFTs absolutely dominate. But why?

PFP NFTs have become far more than just a series of JPEGs.

For thousands of people, they act as digital identities, and grant admission to and membership in highly active communities.

Many of these communities have benefits for members, admission to exclusive Discord chat rooms, and offer the rights to the images they purchase. Changing your Twitter PFP to an NFT icon and posting about it attracts members of the community who'll welcome you with open arms, following and engaging with you.

Bored Ape Yacht Club, a highly successful PFP NFT series, even launched a $200,000 treasure hunt for Ape holders, which was solved by a team of expert code breakers.

The PFP NFT trend shows no signs of slowing down, and a recent announcement from Twitter is likely to only accelerate its growth.

Twitter has just announced a monumental move to make NFT PFPs verifiable.

While it’s frowned upon, you could currently set any NFT as your Twitter profile picture. But Twitter’s new technology would allow users to verify their NFT ownership and show a small Ethereum checkmark beside their NFTs, as seen in the picture below.

This is a huge step in the legitimization of NFTs by one of the biggest social networking sites in the world. Giving Twitter users provable ownership of their profile pictures allows people to possess a distinct and unique digital identity and affirm their membership as part of the NFT community.

4. NFT fragments

We know by now that some NFTs are prohibitively expensive. The cheapest CryptoPunk for sale will set you back almost $400,000, as of writing.

But there’s a new trend that’s making high-value NFTs more liquid and accessible to investors: fragmentation.

Fragmentation is essentially breaking up an NFT into smaller pieces (ERC-20 tokens) so people can purchase small parts of an expensive NFT.

It’s easiest to think of NFT fragmentation like shares in a company. When you buy a share, you own a small part of that company.

Similarly, by fragmenting an NFT, it can be broken up into millions of little pieces, or shards, and people can buy their share of the NFT at a lower price.

The strange thing here is that non-fungible token shards are actually fungible, meaning they can be traded or replaced for an identical item.

Returning to the analogy of shares in a company, while there’s no identical company out there that Microsoft can be swapped with, your shares in Microsoft are the same as the shares Bill Gates holds—although you almost certainly have less of them.

While companies and NFTs are not fungible, shares in companies and NFT fractions are fungible.

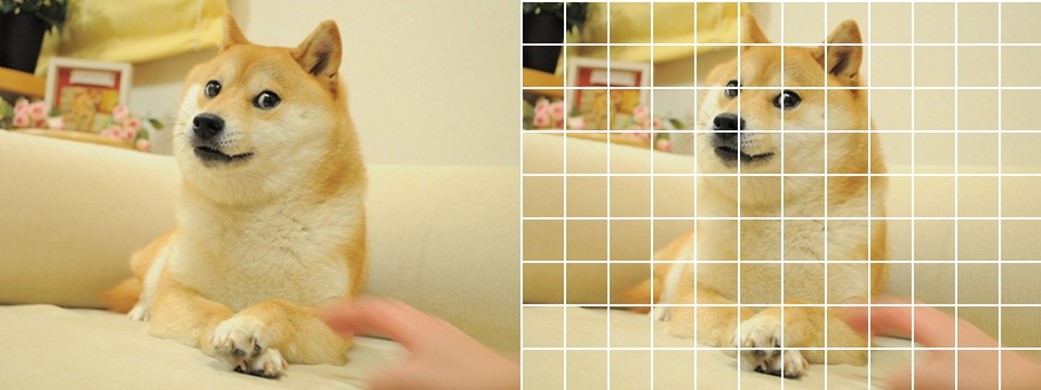

The infamous Doge meme was bought as an NFT for $4 million in 2021. Its owner recently fractionalized the NFT into billions of pieces, allowing users to buy their stake in Doge for less than a dollar.

Investors can vote on future decisions about the NFT, trade $DOG fractions, and own a piece of internet history:

“Doge ownership gives you access to an exclusive set of activities, both on- and woofline. Consider this your lifetime ticket to a perpetual festival of delight and entertainment brought to you directly by the Doge community.”

Even Picasso’s art has been fractionalized as an NFT, allowing 4,000 lucky bidders to purchase part ownership of the artwork Fillette au beret.

5. Digital twin NFTs

“All consumer products—that can’t be eaten—in the next 10 years will have digital twins. They will have NFTs,”

This is the bold claim of Tether co-founder William Quigley.

So what’s a digital twin and why does it belong on this list?

A digital twin is a digital copy of a physical product or asset. Essentially it allows for a digital record of ownership of physical assets.

You might ask why anyone would need an NFT of item when they own the real physical version of it.

The answer is in the question: how can anyone be certain their asset is the real deal?

In 2019, trade in fake goods made up 3.3% of total world trade. A recent report found that up to 20% of all paintings owned by museums may be inauthentic. In the sneaker space, this issue is so large that StockX, a sneaker verification and resale platform, is valued at almost $4 billion.

Aaron Aguliar, brand protection manager for UL, told the New York Times:

“The quality of counterfeit products has greatly improved from what they used to be, and in virtually every industry you can think of. If you can make a dollar, then a counterfeiter is going to find a way to exploit that demand.”

The history and authenticity of a real-world item is always uncertain, especially when purchased from resellers. Sure, the new shoes you bought on eBay look like Nikes, but if you’re not buying them directly from Nike, how can you be certain?

In short, it’s constantly getting harder to tell real assets from fake ones.

The solution?

Digital twin NFTs.

With digital twin NFTs, physical items would be linked to a NFT and stored on a decentralized blockchain that’s near-impossible to manipulate.

Again, the NFTs aren’t the physical items, but a tool for verification of those items. Think of it like a receipt or a certificate of authenticity that is secured, publicly accessible, and holds the full history of the item.

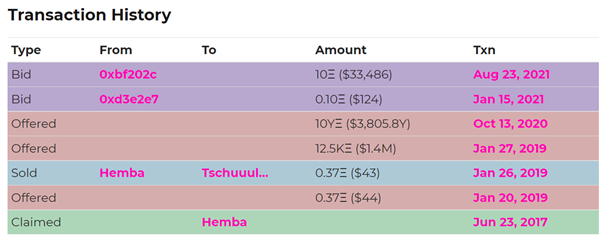

Below is the full transaction history of CryptoPunk 3348. We can see who the first owner is, who has made offers on it, and the one lucky person who bought it second-hand for $43 in 2019.

Imagine this same type of record existing for physical items. It would completely change resale markets.

Here, when Nike makes shoes, they would also mint NFTs to go with them. When you buy a pair of shoes, you’d get not only the shoes, but also the digital twin NFT. You can then sell the shoes and the NFT onto someone else, who can clearly see the product’s full history.

You can imagine high school kids in 2030 showing up to school with new shoes. Along with their Jordans, they’d need to show off the contents of their digital wallets for people to believe them.

This may come sooner than 2030 though, with brands like Nike and Louis Vuitton already hopping on the NFT train to fight against increasingly sophisticated counterfeiters.

Generate hype, deliver fairness & set your NFT project up for success with your free 8-step interactive NFT drop checklist

LVMH, Prada, and Cartier have partnered on their own bespoke blockchain, Aura, which is used to tokenize ownership over real-world luxury goods. They’re betting big on NFTs with Aura, and the service may soon replace the current standard of certificates of authenticity.

Nike has patented its own blockchain based system of verification, called CryptoKicks. From the looks of the patent, CryptoKicks won’t only allow verification of real-world ownership, but may also act like an NFT game, allowing users to breed, buy, and sell shoes.

Image by John Sousa

RELATED: How Major Retailers Are Using NFTs To Drive Sales & Boost Brand Loyalty

6. AI NFTs

Alongside blockchain, artificial intelligence (AI) is the next major disruptor in tech. So it should be no surprise the two are being combined.

AI generated art

The first major trend here is AI creating NFTs.

This is not a new phenomenon. In 2018, Obvious Art sold an artwork created by an AI called GAN at Christie’s for over $400,000. But the introduction of NFTs has made the value of digital assets widely recognized, and today new AI projects are spitting out new artworks and minting them as NFTs every day.

The artwork below, Arlequín, was created by an AI called Alicia.

Alicia studied over 9,100 paintings from renowned artists, completing 300,000 iterations of complex computing to understand the patterns and techniques of the artists. This produced Arlequín, just one of many one-of-a-kind paintings Alicia has created.

It was bought as an NFT for just over $400 (0.1 ETH) on AI Made Art.

Imagine explaining that to your parents. The artwork is not only a digital one stored on the blockchain, but was also created by artificial intelligence.

iNFTs

The second major intersection of NFTs and AI is intelligent NFTs (iNFTs).

iNFTs are NFTs that are given an AI personality. You can have conversations with them, they can learn new things and change their personality, and they live on the blockchain.

Alethea AI is driving the iNFT phenomenon. They sold the iNFT below, Alice, for almost $500,000 at Sotheby’s.

Alethea AI recently received $16 million in funding from big players in the NFT space. They’ve used this to create their own metaverse called Noah’s Ark, filled with iNFTs.

Here, they plan to introduce a new revenue model called “train-to-earn” allowing players to train their iNFTs to become more intelligent and earn money by participating in “Battle of the minds“.

These iNFTs may one day be dropped into other metaverses like Sandbox and Decentraland, where users could interact with them as though they are other players in the game.

In the future, your iNFT could live in your virtual home in Facebook’s metaverse. When you’re not online, your friends could come by your virtual home to talk to your personal AI, who’s imbued with your personality. She’ll explain to them where you are and tell them a little bit about what you’ve been up to lately. The next time you log on, she’ll be waiting and tell you James visited and asked about your family.

7. NFT streaming and community-owned entertainment

NFTs are often praised for ushering in a creator economy. They’ve given thousands of artists the chance to produce and sell their creations on their own terms. But the potential for the NFT creator economy goes far beyond empowering visual artists and changing the art world.

NFT music

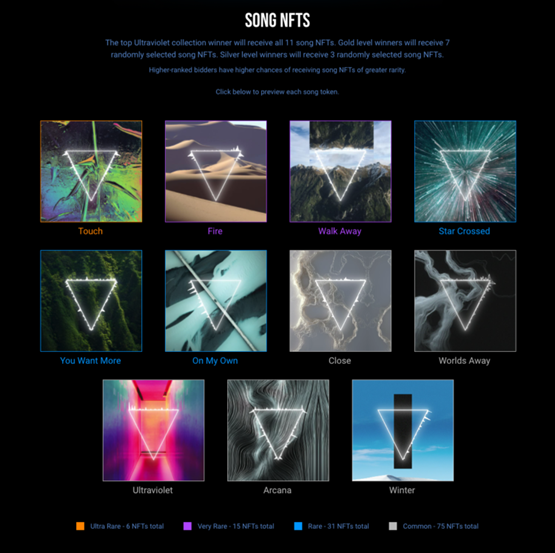

DJ 3LAU was the first musician to tokenize an album, making $11.6 million off the 33 NFTs of the album he sold. His next project, Royal, is looking to shake up the world of music streaming.

With $16 million in funding, Royal aims to allow ownership over songs through tokenizing them. These song NFTs can then be fractionalized by musicians, and they can sell part ownership of the song to fans and investors while maintaining their majority stake.

The royalties for the streaming of the song would then be distributed among the many owners of the fractionalized asset.

Imagine it like this: an artist you love creates a new track that you think will be the next big hit. You see they’ve minted it as an NFT, fractionalized the NFT, and are selling shares in the song through Royal. You buy up 30% of the song. A month later, the song goes viral. Everyone’s streaming it, TikTok influencers are dancing to it, and Coca-Cola wants to use it for their new commercial.

Along with the artist who made the song, you’d make money off the song going viral. You’d get to play the song at parties and tell your friends you’re a part-owner of it. You’d even be able to sell your share of the song at a profit.

This allows fans to invest in and support artists, and artists to give back to their strongest supporters by sharing out their revenue—when and if the song makes money.

NFT movies and TV shows

It sounds like I’m making this up, but a recent star-studded NFT animated series called Stoner Cats included voice acting from Mila Kunis, Chris Rock, Jane Fonda, Seth MacFarlane, and Vitalik Buterin (the creator of Ethereum).

It’s a show about a group of cats who become self-aware. I’d tell you more about it, but you can’t watch the series unless you buy a Stoner Cat NFT.

The Stoner Cats are around $1,000 (0.3 ETH) as of writing, and there are only 10,400 in existence. There are almost 5,000 cat owners, and these are the only people who have access to the show.

You may ask why anyone would pay $1,000 to watch an animated series. But buyers get more than that.

By purchasing a Stoner Cat, you are helping to fund the future of the series. As a Cat owner, you get to vote on the plot of the show for future episodes. You become a part of the Stoner Cat community. And you have an asset that could appreciate in value if the show and project grow in popularity.

Just as in the world of NFT music streaming, Stoner Cats is removing the middlemen, creating a new space in which there’s only the animators and their fans.

And this is just the beginning for NFTs entering the world of entertainment:

- Fox Entertainment is putting $100 million behind several NFT projects including a new animated series on the blockchain

- Warner Bros released collectible NFTs along with the debut of the film Dune

- Vuele recently released an Anthony Hopkins film as an NFT

- Steve Aoki has secured funding for a new NFT show

- Disney is releasing digital collectible NFTs paired with subscriptions to Disney+

- Jambb is letting comedians sell jokes and comedy specials as NFTs

8. NFTs and fine art

Anyone who knows anything about NFTs knows they’ve revolutionized the concept of digital art. We’ve already looked at fractionalized Picasso NFTs and AI generated art, but there are a few other trends in NFT art which show potential to shake up the traditional art world.

NFT Art funds

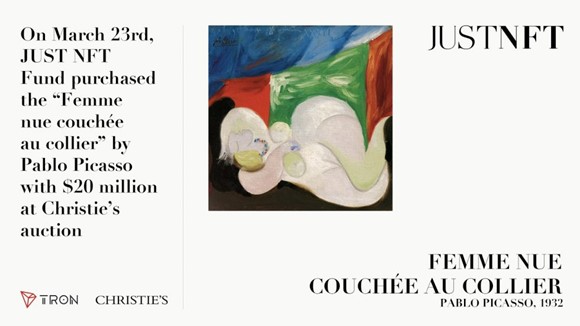

Over the past year, Justin Sun, founder of crypto platform TRON, has snatched up $30 million worth of Picasso, Warhol, and Beeple and turned the artworks into NFTs—a sure-fire way to capture the attention of the art world.

"We estimate 50% of the world’s top-notch artists and artworks to be recorded as NFTs in the following decade. And that’s where JUST NFT can come into play," Sun said in an open letter to the community.

If Sun is right, we’re likely to not only see new digital artworks created and sold as NFTs, but galleries and private funds minting digital twin artworks.

QR codes could appear beside every painting in galleries to verify their authenticity. Art investors could demand NFTs alongside their purchase of classical artworks. Virtual galleries could accompany real-world ones, allowing people to visit the Louvre in the metaverse.

Metaverse galleries and auction houses

Sotheby’s, the 250-year-old fine art auction house, is already moving in this direction. They recently released their own Sotheby’s Metaverse, where they display the NFT artworks they have for sale and run auction events.

Their latest event, Natively Digital 1.2, saw a massive $18.6 million in sales.

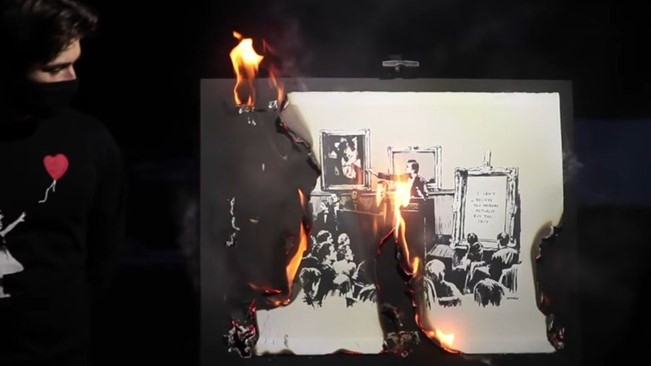

Destroying art, creating NFTs

In the world of NFTs, burning means destroying an NFT. The burning of one NFT is usually used to create scarcity and raise the value of other NFTs.

Earlier this year, blockchain firm Injective Protocol took burning NFTs to a new level. They bought a $95,000 Banksy artwork titled Morons, and literally burned it. They filmed the burning of the artwork and sold it as an NFT.

This takes digital twin to a new level. The physical item is destroyed, and all that’s left is the NFT.

These trends show that NFTs and digital art are not just for new, young artists, but are creeping into the traditional art world. And they may one day take over.

9. NFTs and health

We’ve all heard that data is the most valuable asset in the digital economy. But most people have very few ways they can actually monetize their personal data.

Aimedis is working to change that. They’ve launched the world’s first medical and scientific NFT marketplace, allowing medical data to be bought and sold as NFTs.

Through Aimedis, patients could turn their medical data into NFTs to be sold to pharmaceutical companies. This empowers patients to own and monetize their personal medical information, providing new revenue streams to those willing to take part.

But medical NFTs get even weirder.

Singapore-based start-up Engin has created an NFT project called Health Hero, which has a simple mission: to bring health and happiness to over 1 billion people.

How are they planning to achieve this?

Well-being NFTs (W-NFTs).

When you sign up for Health Hero, you get a W-NFT that you link with tracking devices and apps like Apple Health, Google Fit and FitBit.

By exercising, meditating, and eating well, you can grow and develop your W-NFT, giving it unique new characteristics and making it increasingly rare.

These W-NFTs can be bought and sold, so the more you exercise, the rarer and more valuable your W-NFT becomes.

And, of course, they have their own metaverse, Health Hero City.

Deloitte predicts blockchain technology may transform healthcare by ”placing the patient at the center of the healthcare ecosystem and increasing the security, privacy, and interoperability of health data.”

With issues surrounding counterfeit vaccination passports and concerns about the vulnerabilities of centralized data storage of sensitive medical information, NFTs and the blockchain may well be integrated more and more into medicine and health in the years to come.

10. NFTs and finance

In the third quarter of 2021, the sales volume of NFTs was an estimated $10.7 billion. That kind of money doesn’t get spent without capturing the attention of the financial world.

The NFT market is valued at billions of dollars, but NFTs are speculative and non-fungible assets. Like real estate, you can’t make money off NFTs just by buying and holding onto them.

They need to be sold and move around the market for the NFT economy to function and for investors to profit.

New services are allowing this by using NFTs as collateral for loans. Like fractionalization, this allows NFT investors to gain back liquidity from their investments without sacrificing ownership.

Say you have a million-dollar NFT in your digital wallet, but no money in your bank. You see an investment opportunity that you believe will result in reliable returns, but you’re not willing to part with your precious NFT. Services like Drops let you take loans by putting your NFTs up as collateral. Think of it like a mortgage, you leverage the asset you own to create liquidity.

The world of cryptocurrencies and decentralized finance is booming, and NFTs definitely have a seat at the table.

- Among the speculation about the future of NFTs in finance are claims NFTs could solve the problems of financing long supply chains

- Numerous venture capitalist firms are now solely focused on investing in NFT projects and Web 3.0

- Even Visa is entering the NFT scene. They spent $150,000 on a CryptoPunk, and announced they’ll be “laying the groundwork to enable adoption of NFTs and other assets in the future.”

11. Scaling the blockchains, scaling the websites

Scalability is a hot topic in the crypto world. As uptake of cryptocurrencies and NFTs soars, thought leaders in the crypto space are concerned blockchains won’t be able to handle the increased data storage and transaction volume.

The founder of Ethereum, Vitalik Buterin, has written extensively on this. Elon Musk has tweeted about it. And scalability is the key selling point behind multiple new crypto projects.

There’s much focus on this and many minds working to solve blockchain scalability, with a lot of hope for Ethereum 2.0. So here we’ll focus on the type of scalability that’s a bit more straightforward and solvable: website and app scalability.

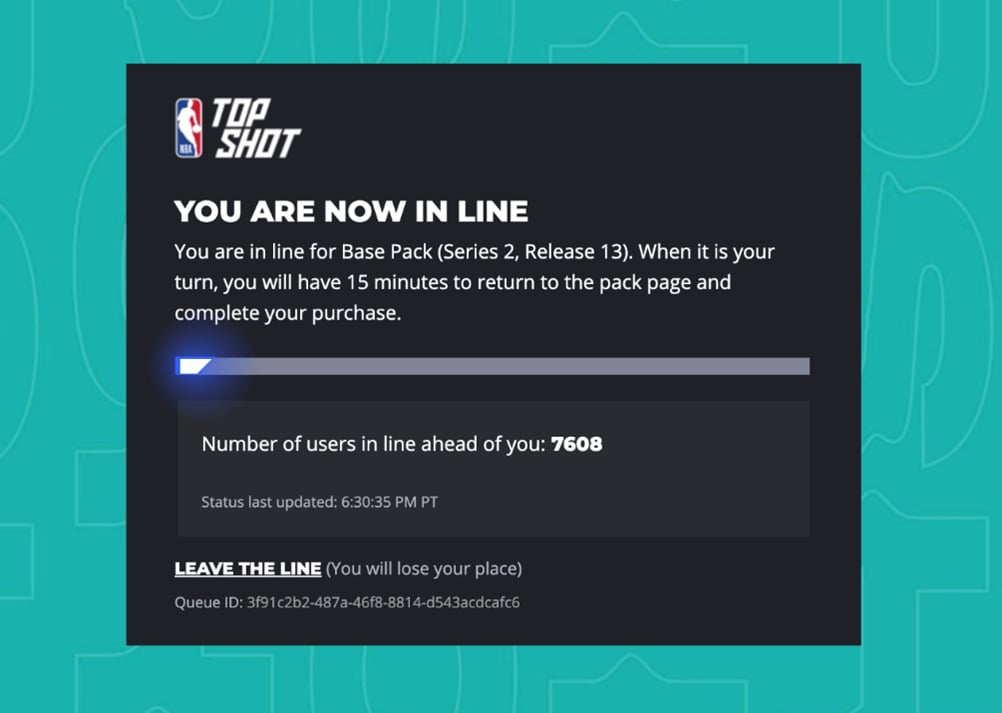

Just like blockchains, websites and servers are not infinitely scalable. Websites have capacities, and many new NFT projects are confronting the issue of not being able to scale their systems to match the high demand for NFTs.

RELATED: Why Scaling Your Website is so Hard

As users flood websites, hyped NFT releases have crashed marketplaces from OpenSea to Christie’s to Makersplace.

NFT businesses are fast realizing the interest in NFTs too often exceeds the capacity of their websites. With customers expecting fair, orderly, and problem-free product releases, NFT businesses are seeking out new ways to control the traffic surges that come with NFT releases. And virtual waiting rooms are playing an important role in that process.

With a virtual waiting room, when a site or app’s capacity is exceeded, visitors are redirected to a branded waiting room on another server using a standard HTTP 302 direct. They’re then throttled back to the website in a first-come, first-served order, allowing websites to control online traffic and creating a seamless user experience.

Marketplaces like NBA Top Shot, DraftKings, and Sandbox have implemented virtual waiting rooms to manage their traffic and ensure their NFT rollouts proceed fairly and smoothly.

As NFTs are adopted by big companies and celebrities, and continue to make headlines and disrupt major industries, demand for NFTs will continue to rise.

And while developers are working hard to ensure blockchains will scale to meet this demand, many NFT businesses aren’t addressing the issue of scalability for their own Web services.

The future of NFTs

The NFT space is fast-changing. While writing this, new NFT projects popped up every day. From the Busan Metropolitan Government in Korea announcing an NFT conference, to the International Cricket Council launching cricket NFTs, to CoinRunners crowdfunding a movie by selling NFTs.

The few consistent NFT trends over the past year have been their steady growth, the rising interest in them, and their ever-expanding applications.

The future these NFT trends depict is an interesting one. While many people are concerned about the implications of the metaverse and the rise of AI, it’s a future that's full of possibility.

It’s a future which bridges the gap between consumers and creators, gives value and security to digital assets, and one which, for better or for worse, will shake up the world.