Holiday Season web traffic grows 12%. Cyber Five traffic increases 11%. Two in three Cyber Five web visits come from a mobile device. One in three come from a bot or data center. Discover the key statistics and trends 2.3 billion online visitors reveal about the global 2024 Holiday Season. And get four key takeaways for online retailers to prepare for 2025 holiday shopping.

After three straight years of growth, ecommerce web traffic during the Holiday Season fell for the first time in 2022, then only marginally (+0.4% YoY) rose again in 2023.

Heading into the 2024 season, industry predictions varied widely. With a massive election, ongoing inflation, and a cost-of-living crisis affecting many of the world’s largest economies, would consumers ramp up their Holiday Season shopping? Could trends like the growth of mobile commerce, the rise of bot traffic, and the push towards earlier shopping continue?

At Queue-it, we tracked 2.3 billion web visitors across 138 retailers worldwide from Nov. 1 to Dec 19, 2024, to get the answers to these questions and more. Read on to uncover 20+ Holiday Season shopping statistics to help you understand consumer trends and get the most out of the 2025 shopping season.

Queue-it provides a virtual waiting room solution that helps retailers control traffic to their websites and apps, preventing website crashes and blocking bots. Although visitors only see a waiting room page when a website or app experiences traffic overload, Queue-it has insight into all traffic requests while the virtual waiting room is in place.

Note: All year-over-year (YoY) comparisons are made with a control group of retailers Queue-it worked with in both 2023 and 2024. In-year comparisons are made with the full list of 138 retailers.

Table of contents

- Holiday Season traffic grows 12%

- Cyber Five back on top with 11% YoY growth

- Black Friday takes the #1 spot

- Black Friday traffic almost 2x that of average October day

- Electronics remains top traffic category

- Mobile traffic increases 12% during Cyber Five

- Bot & data center traffic across Cyber Five increases 24%

- 83% of suspicious traffic failed a simple challenge

- Key takeaways for the 2025 Holiday Season

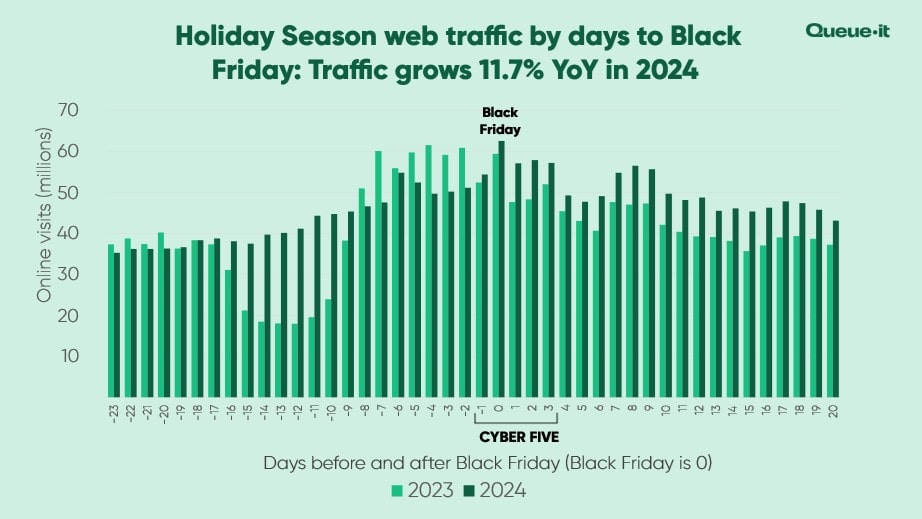

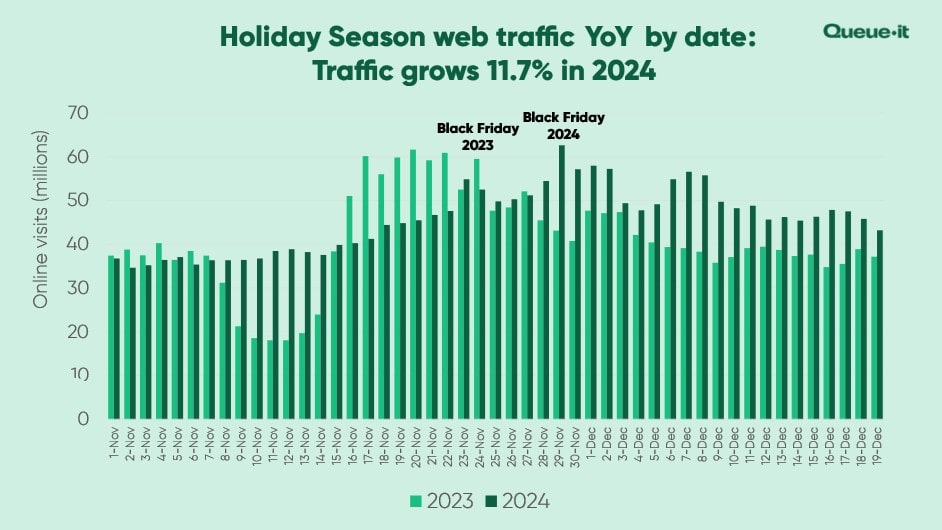

Across the same subset of retailers, traffic from Nov. 1 – Dec. 19 increased by 11.7% year-over-year—from just over 2 billion web visits in 2023 to 2.24 billion web visits in 2024. That’s an increase of over 230 million web visits across the 49 days.

Since Queue-it started reporting on Holiday Season data in 2019, we’ve seen a continual push towards shopping earlier and earlier in the season. But not this year.

Traffic in the first week of November has increased significantly YoY for four consecutive years, even when overall Holiday Season traffic declined. But 2024 broke from this trend, with traffic in the first week of November dropping 5%.

Each of the 15 days in our sample where traffic declined YoY came in the first half of the Holiday Season. And after November 27, every single day saw higher traffic volumes in 2024 than in 2023.

This shift is partially due to a later Black Friday in 2024 (November 29 in 2024 vs. November 24 in 2023). But it’s also a signal that the continual push towards earlier Holiday Season shopping may have plateaued, with consumers wising up to the fact that early deals typically stick around (and sometimes even improve) late into the season.

RELATED: Avoid Ecommerce Website Crashes with a Virtual Waiting Room

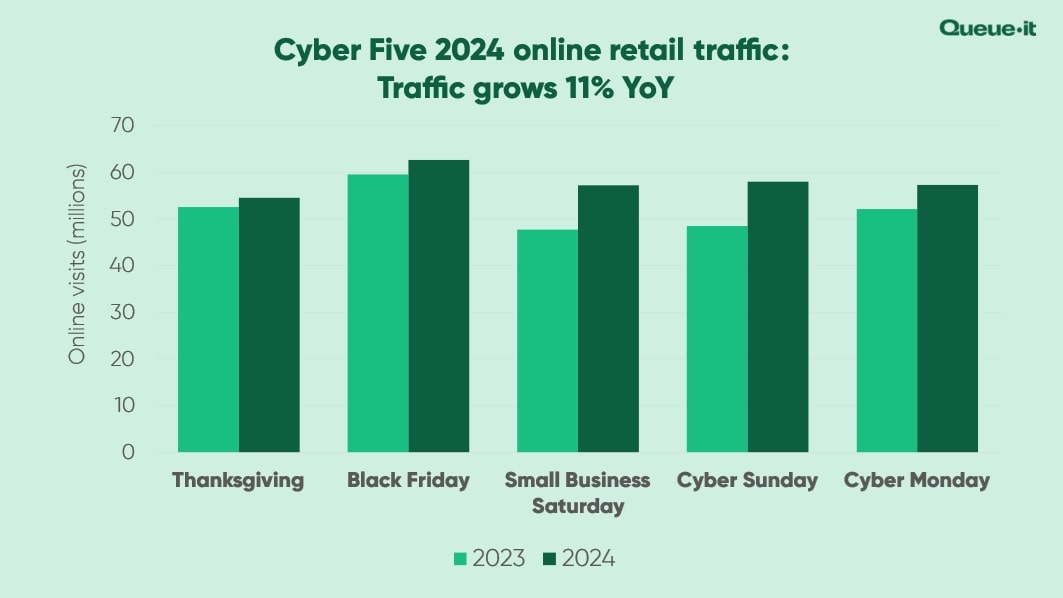

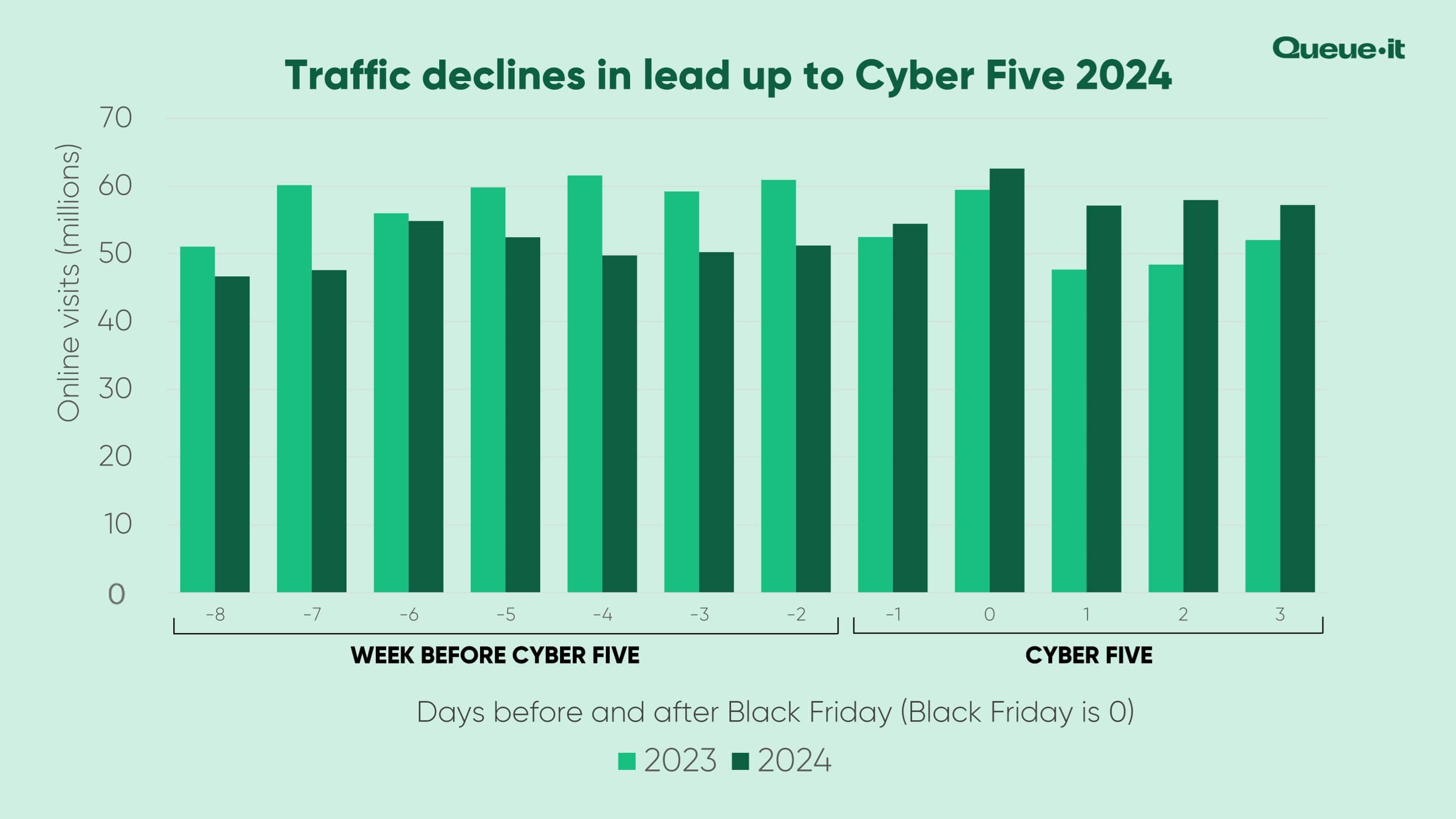

2024’s Holiday Season traffic data revealed the reversal of another trend, with Cyber Five traffic growing YoY for the first time since 2021.

In 2024, Cyber Five traffic increased by 11.3% YoY, from 260 million web visits to 290 million.

Each day from Thanksgiving to Cyber Monday saw larger traffic volumes in 2024 compared to 2023—with a massive 20% YoY increase on both Saturday and Sunday.

Here’s the year-over-year breakdown of the days:

- Thanksgiving: +3.7%

- Black Friday: +5.3%

- Small Business Saturday: +19.8%

- Cyber Sunday: +19.7%

- Cyber Monday: +9.9%

Last year’s large increase in traffic in the days preceding Cyber Five led us to suggest that “Cyber Ten” had become the new Cyber Five. But “Cyber Ten” was nowhere to be seen this year, with YoY declines for each the 7 days leading up to Thanksgiving, then YoY increases on each day of Cyber Five.

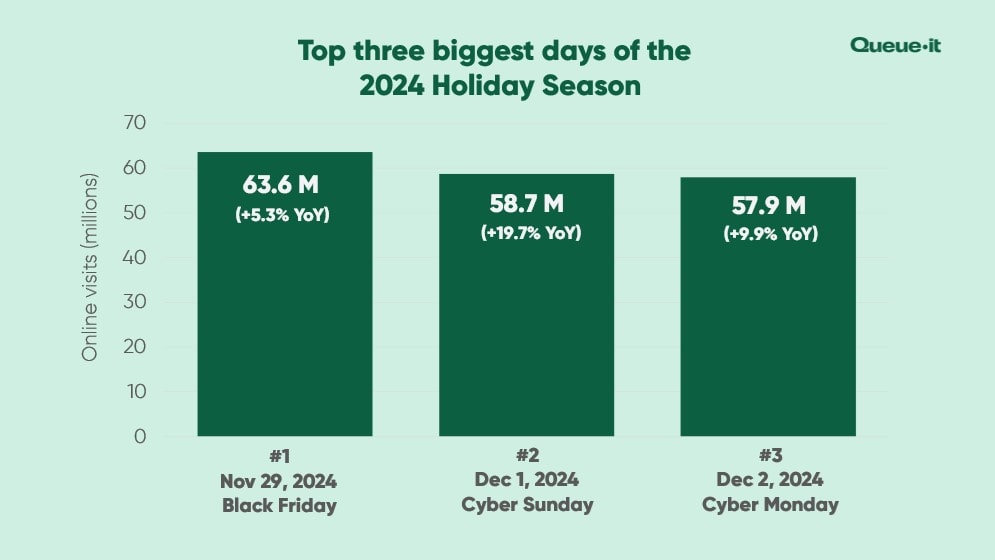

For the fifth year in a row, Black Friday was retail’s biggest day for online traffic, with 63.6 million visitors passing through Queue-it’s waiting rooms on the day, up 5.3% YoY.

Last year’s three biggest days showed how consumers were buying more, earlier. But 2024 paints a different picture, with the season’s second and third biggest days both occurring after Black Friday, and during Cyber Five.

Top three biggest days of the 2024 Holiday Season:

- Black Friday: 63.6M (+5.3% YoY)

- Cyber Sunday: 58.7M (+19.7% YoY)

- Cyber Monday: 57.9M (+9.9% YoY)

U.S. readers may be surprised to see Black Friday and Cyber Sunday traffic exceeding that of Cyber Monday, which was the biggest day of online shopping in U.S. history in terms of sales.

But Queue-it’s dataset comes from retailers across the globe, including many countries in which Black Friday sales are far more widespread than Cyber Monday sales. While 94% of U.S. consumers are aware of Cyber Monday, only 82% of consumers globally know of the shopping holiday. And in countries like France and Brazil, less than 50% of consumers say they’re aware of Cyber Monday.

When we filter our dataset to include only U.S. retailers, Cyber Monday takes the top spot across Cyber Five—edging out Black Friday by 19.4%.

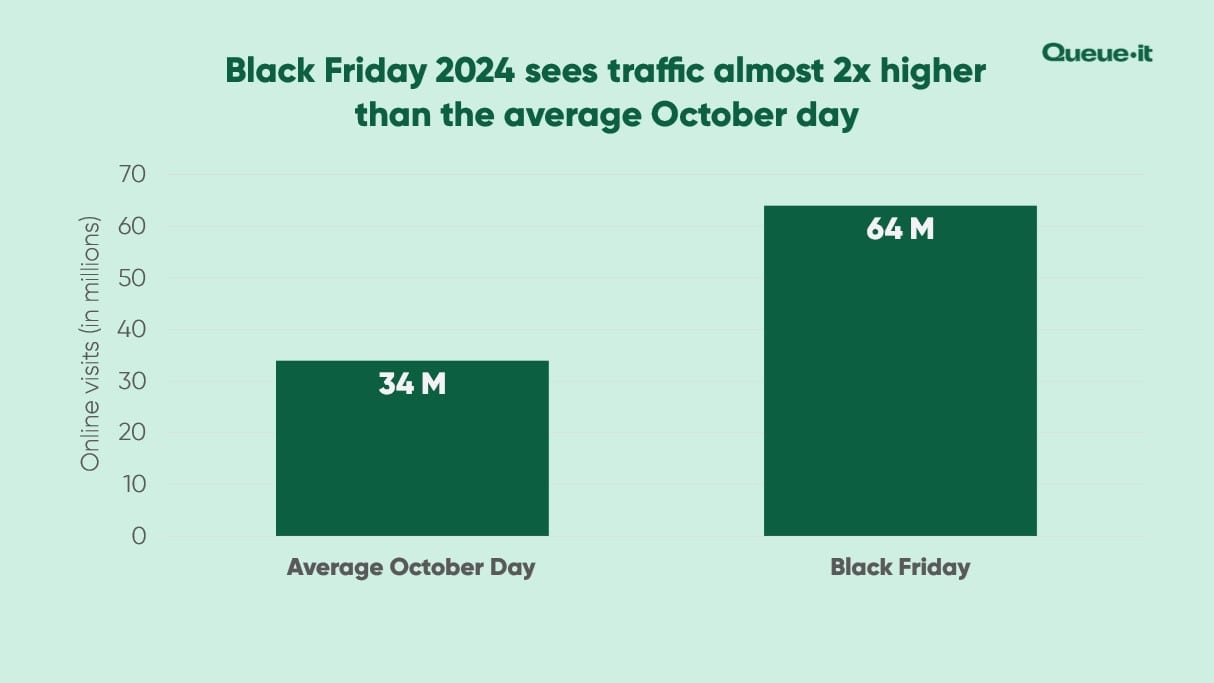

Black Friday 2024 saw five million more visitors than any other day across the Holiday Season. The 64 million visitors Black Friday drew in was almost double that of an average October day (34 million web visits).

The continued dominance of Black Friday—and rise of Cyber Five—show that major traffic spikes on the Holiday Season’s key days aren’t going anywhere. This year’s Black Friday traffic surge crashed major retail websites across the globe, including Costco, Lego, and Chemist Warehouse, leading to millions in lost sales revenue.

And website crashes weren’t the only problem high demand caused across the Holiday Season. Customers on social media complained of cancelled orders of oversold stock at Macy’s, Amazon, Coach, and Home Depot. Overselling like this typically occurs when retailers are selling items faster than their database and inventory management systems can keep up.

RELATED: Overselling: Why Ecommerce Sites Oversell & How to Prevent it

For the retail customers in this report, however, website crashes and overselling weren’t a problem. With Queue-it’s virtual waiting room in place, these retailers controlled extreme traffic spikes, ensuring the flow of visitors to their website or checkout never exceeded what their systems could handle.

Break Black Friday sales records without breaking your site

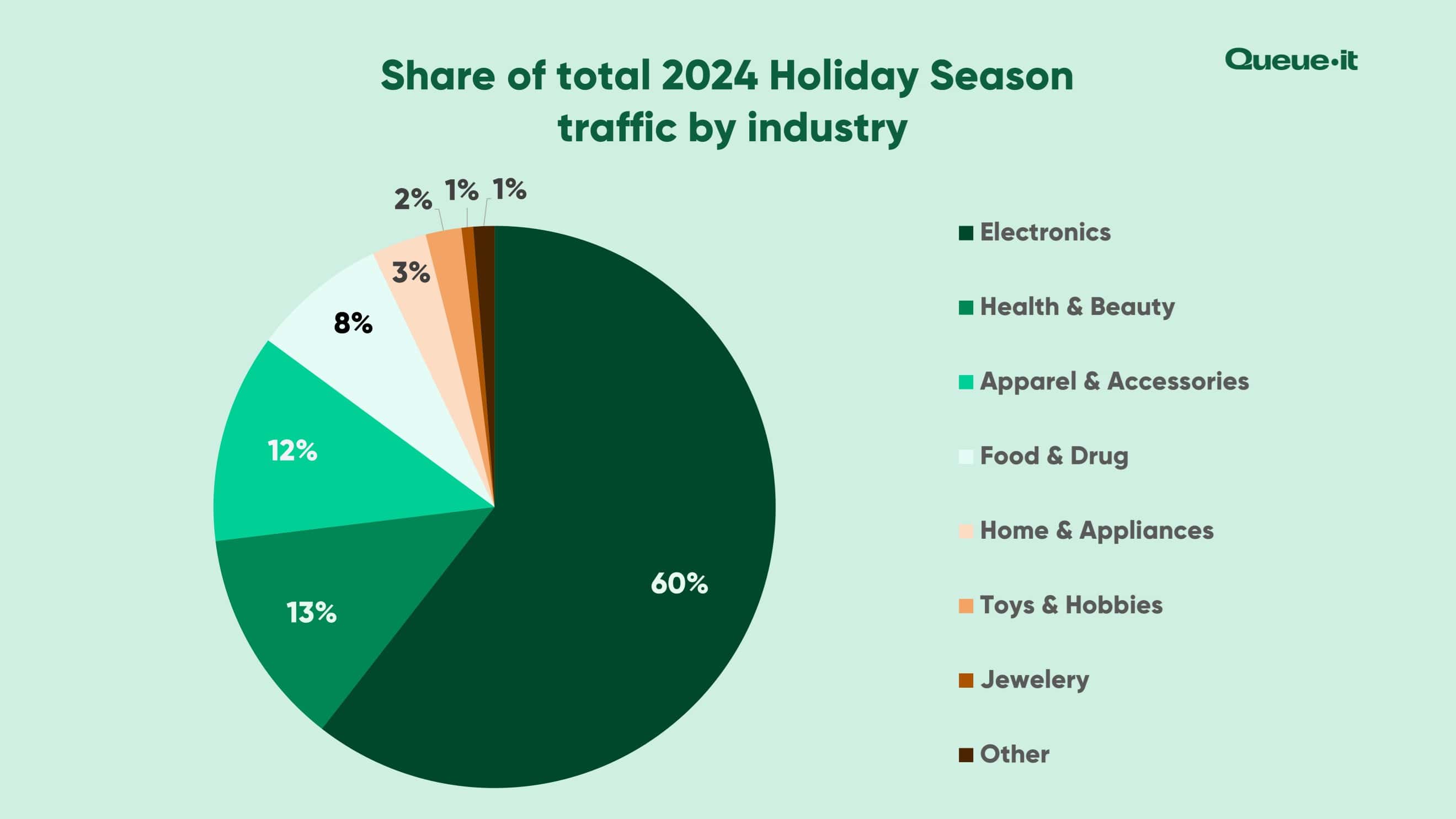

For the fifth year in a row, electronics retailers saw the largest share of Holiday Season web traffic, accounting for 60% of total traffic and over a billion web visits, up from 53% in 2023.

Health and beauty retail web visits (285 million) overtook apparel and accessories visits (273 million) in 2024, claiming the number two spot.

Here’s the traffic breakdown by category

- Electronics: 60% (1.4 billion web visits)

- Health & beauty: 13% (285 million web visits)

- Apparel & accessories: 12% (273 million web visits)

- Food & drug: 8% (177 million web visits)

- Home & appliances: 3% (72 million web visits)

- Toys & hobbies: 2% (47 million web visits)

- Jewelry: 1% (15 million web visits)

- Other (including sporting goods, department stores, hardware, and more): 1% (28 million web visits)

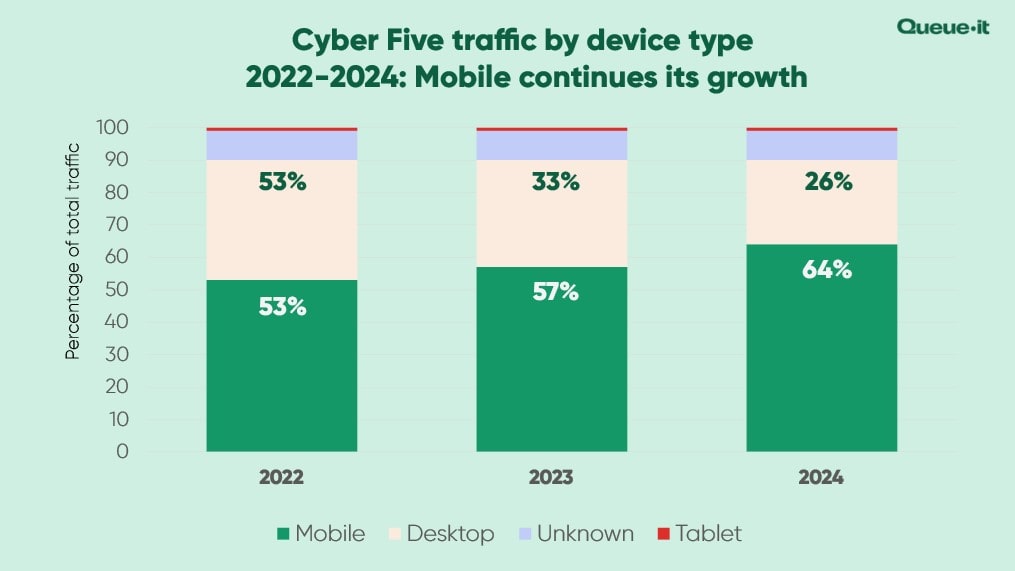

For the third year in a row, we saw an increase in mobile traffic across Cyber Five.

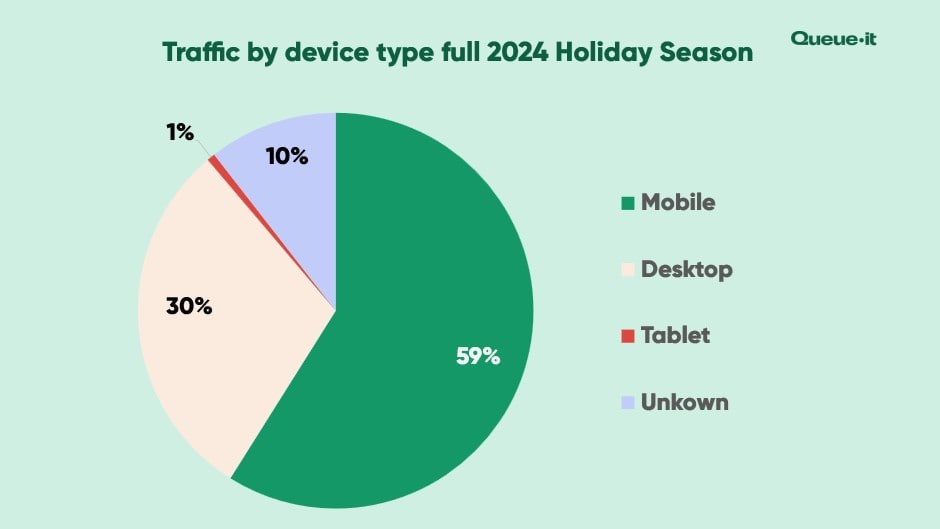

In 2023, 57% of Cyber Five traffic came from mobile devices. In 2024, that number jumped to 64%, representing a 12% increase YoY.

The rise in mobile traffic came at the expense of desktop traffic, which fell from 33% in 2023, to 26% in 2024.

Tablets made up 1% of traffic for the third year running.

And, just as last year, 9% of traffic came from an unknown device, which typically occurs if the session comes from a data center, or the shopper is masking their device type with a VPN.

Cyber Sunday was the biggest day of Cyber Five for mobile traffic, with more than two-thirds (67%) of all traffic coming from mobile devices.

Cyber Monday, just as last year, saw the lowest mobile traffic out of the Cyber Five days, with 59% of visits coming from mobile devices.

Across the full Holiday Season (from Nov. 1 – Dec 19), mobile took a slightly smaller share of traffic by device type, with 59% of all web visits coming from mobile. On Friday December December 6th (one week after Black Friday), 79% of all traffic came from mobile devices, making it the biggest day of the season for mobile.

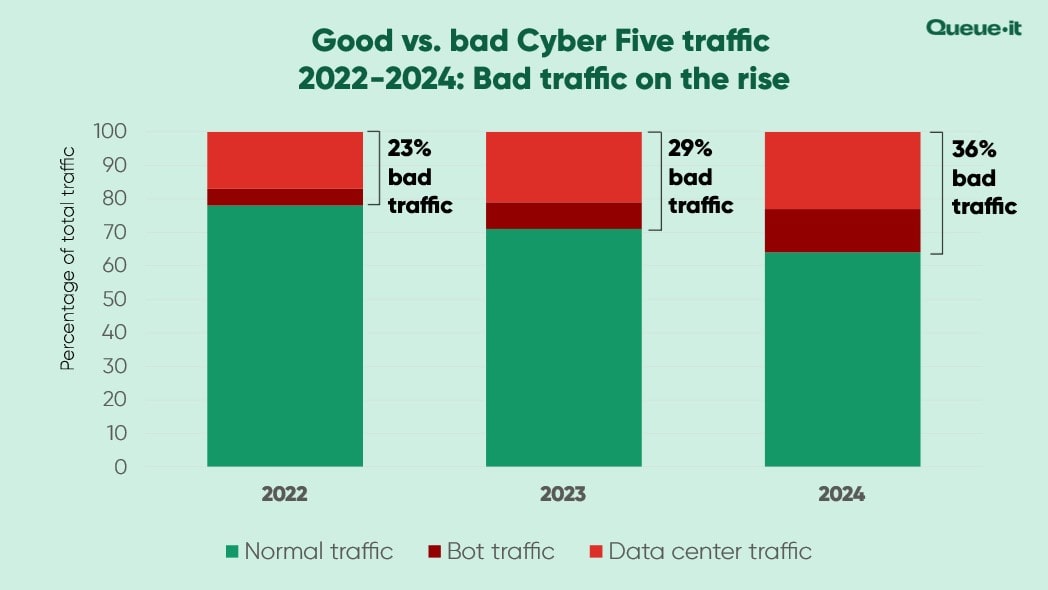

For the third year in a row, we saw the increase of “bad traffic”—comprised of traffic that comes from bots and/or data centers.

In 2023, 29% of all Cyber Five traffic was bad traffic. In 2024, it jumped to 36% (+24% YoY).

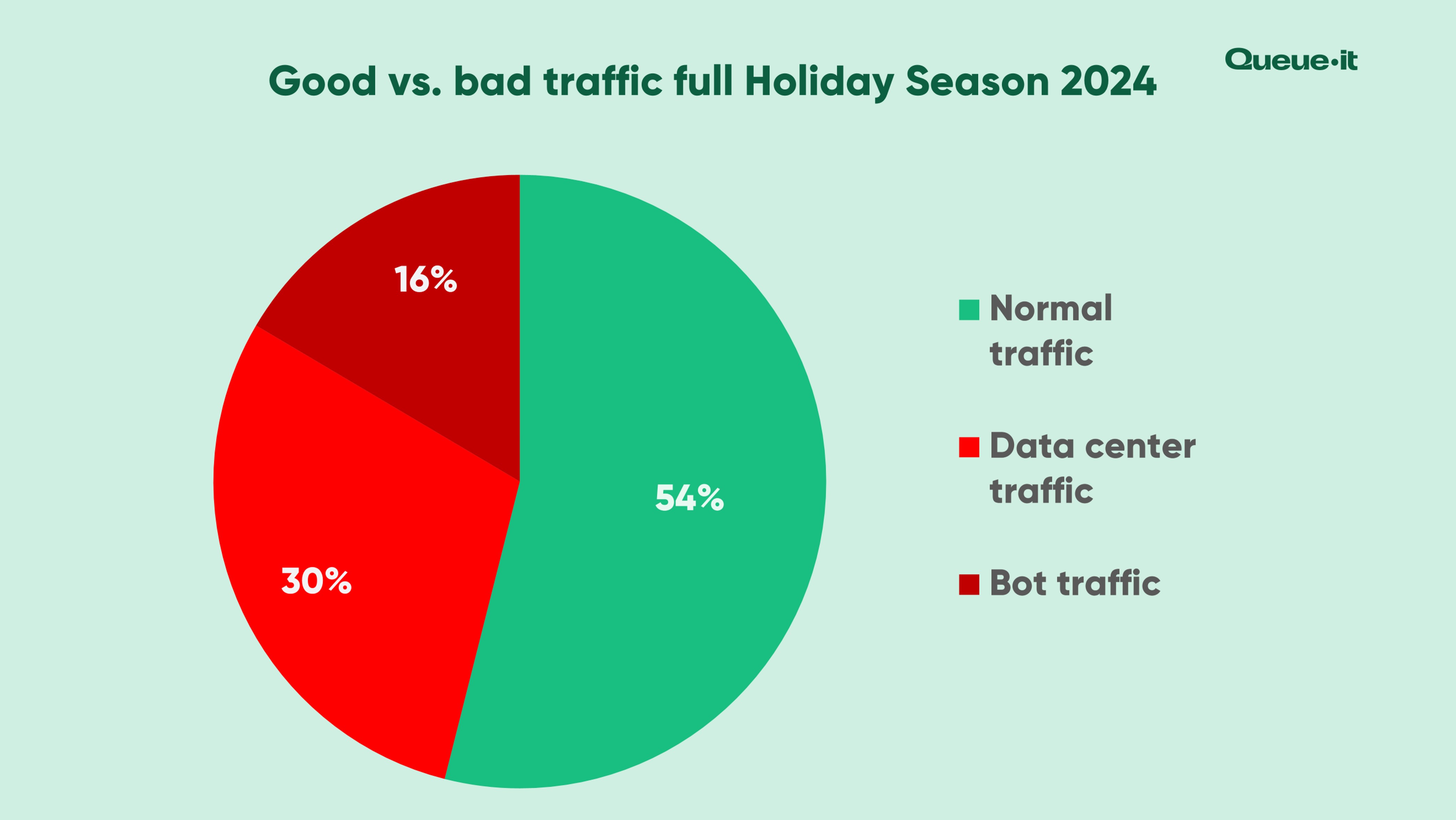

That means more than one in every three site visitors across Cyber Five came from a bot or data center.

Data center traffic comes from massive buildings with racks of servers and computing infrastructure. Traffic from a data center rarely comes from a genuine visitor. Most likely it's a bad bot or malicious web scraper running on a rented server, or a visitor trying to mask his or her identity by connecting with a VPN whose server is in the data center.

Unusual traffic requests (labelled below as “bot traffic”) come from visitors whose behavior or technology setup suggests to Queue-it they're not genuine.

This year, 23% of traffic came from data centers (up from 21% in 2023), and 13% came from bots (up from 8% in 2023). Note that a request can be flagged as both unusual and from a data center, so the range is as low as 23% and as high as 36%.

For the second year in a row, Cyber Five’s biggest day for bad traffic was Cyber Monday, where more than 50% of traffic was flagged as suspicious—with 30% coming from data centers and 21% flagged as bot traffic.

Across the full Holiday Season (Nov. 1 – Dec 19), bad traffic took up an even more significant portion of overall traffic, with a massive 46% of all web visits across the 49 days flagged as either bot or data center traffic.

The worst day across the full season came on the 11th of December, when bad traffic made up 83% of all traffic through Queue-it’s systems.

Bad traffic drives up retailers’ cloud computing costs, distorts conversion rates and other important analytics, and can even crash your site if it comes in too much volume.

Queue-it’s suite of bot mitigation tools help retailers identify and act on malicious traffic. With Traffic Insights, you get access to detailed, real-time traffic info detailing all suspicious and malicious activity (including data center and unusual requests). And with our bots and abuse packages, you can automatically block and challenge bad traffic, or configure detailed access rules, including visitor identification tokens, IP address blocking, and reputation scores.

RELATED: Block Bots & Abuse with Multi-Layered Site Protection

When customers enable Queue-it’s Anomaly Detection or Traffic Access Rules, they can challenge or hard-block traffic according to the parameters they’ve set up.

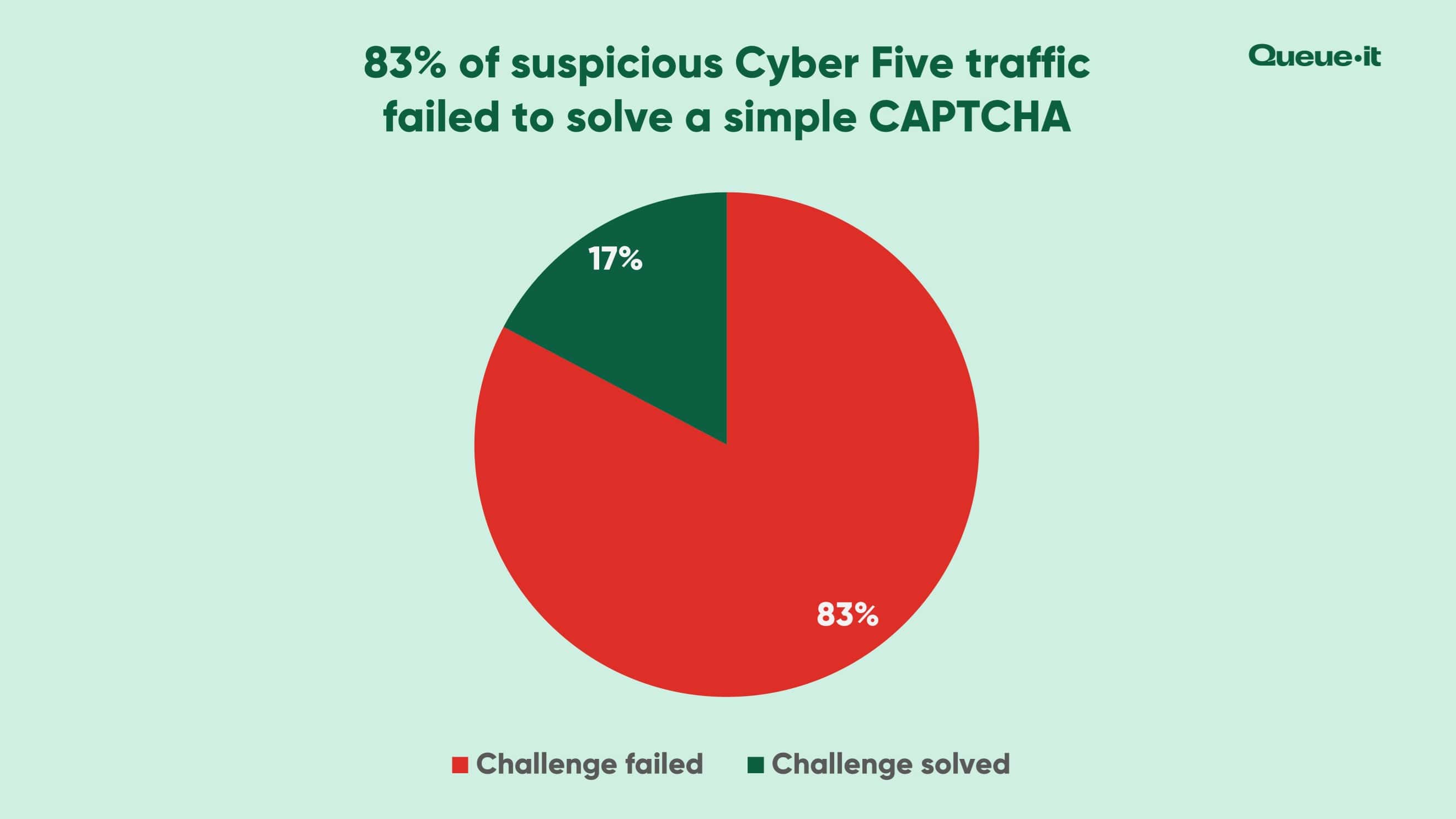

The challenges include a simple CAPTCHA test or a Proof-of-Work Challenge—which is invisible to human users but creates issues for bots.

During last year’s Cyber Five, 94% of all suspicious traffic failed to pass these challenges.

This year, that number dropped to 83%, signaling an increase in bot sophistication and a greater need for more robust bot mitigation tactics.

Nonetheless, challenging traffic still proves effective at blocking the bulk of simple bots, with just 17% of suspicious traffic completing the challenges.

Across the full Holiday Season, 70% of suspicious web visits failed to solve a basic CAPTCHA challenge, resulting in 26 million bots blocked.

- Make mobile-first a priority: Two-thirds of shoppers across Cyber Five used mobile devices in 2024. The growth in mobile commerce has been the most consistent trend we’ve seen over the past five years and it’s not slowing down. Mobile-first web design is essential to Holiday Season and overall ecommerce success.

- Trends have ends: 2024 saw the reversal of two trends which have defined the past three Holiday Seasons: (1) the ever-increasing push towards early shopping, and (2) the related decline of Cyber Five as the only “key days” of the season. It’s a good reminder that not all trends can continue to move in the same direction forever. Don’t get us wrong: starting Holiday Season sales early remains essential, but our data shows consumers may be growing weary of “Black Friday sales” running 25+ days before Black Friday.

- Prepare for peaks: As happens every year, surging Holiday Season traffic caused crashes and overselling for many major global retailers in 2024. With extreme competition and huge sales opportunities, retailers can’t afford to get their Holiday Season sales wrong. The 138 retailers in this report kept their sites online and their customers happy with Queue-it’s virtual waiting room.

- Get ready for grinch bots: Across all our year-over-year comparisons, one number is the most striking: bad traffic (grinch bots) increasing by 24%. One in every three Cyber Five web visits in 2024 was non-human, and our data shows they’re growing in sophistication. These bots spike your costs, take gifts from genuine customers, spoil your analytics, and can even crash your site. To succeed next Holiday Season, you need to prepare for the bad bot onslaught with detailed website analytics and multi-layered bot protection.

This report is based on web traffic from a sample of 138 of Queue-it's online retail customers. The retailers are based in 38 countries across 6 continents. All traffic date stamps are based on UTC. Year-over-year comparisons are made with an identical set of 112 retailers who used Queue-it for Holiday Season sales in both 2023 and 2024. In-year comparisons are made with the full data set (138 retailers).