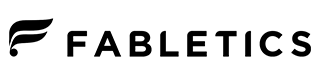

"Queue-it is a game-changer in terms of what it helps us accomplish (launching massive traffic events with zero disruption in the *branded* user experience). It speaks for itself."

Alex Wakim

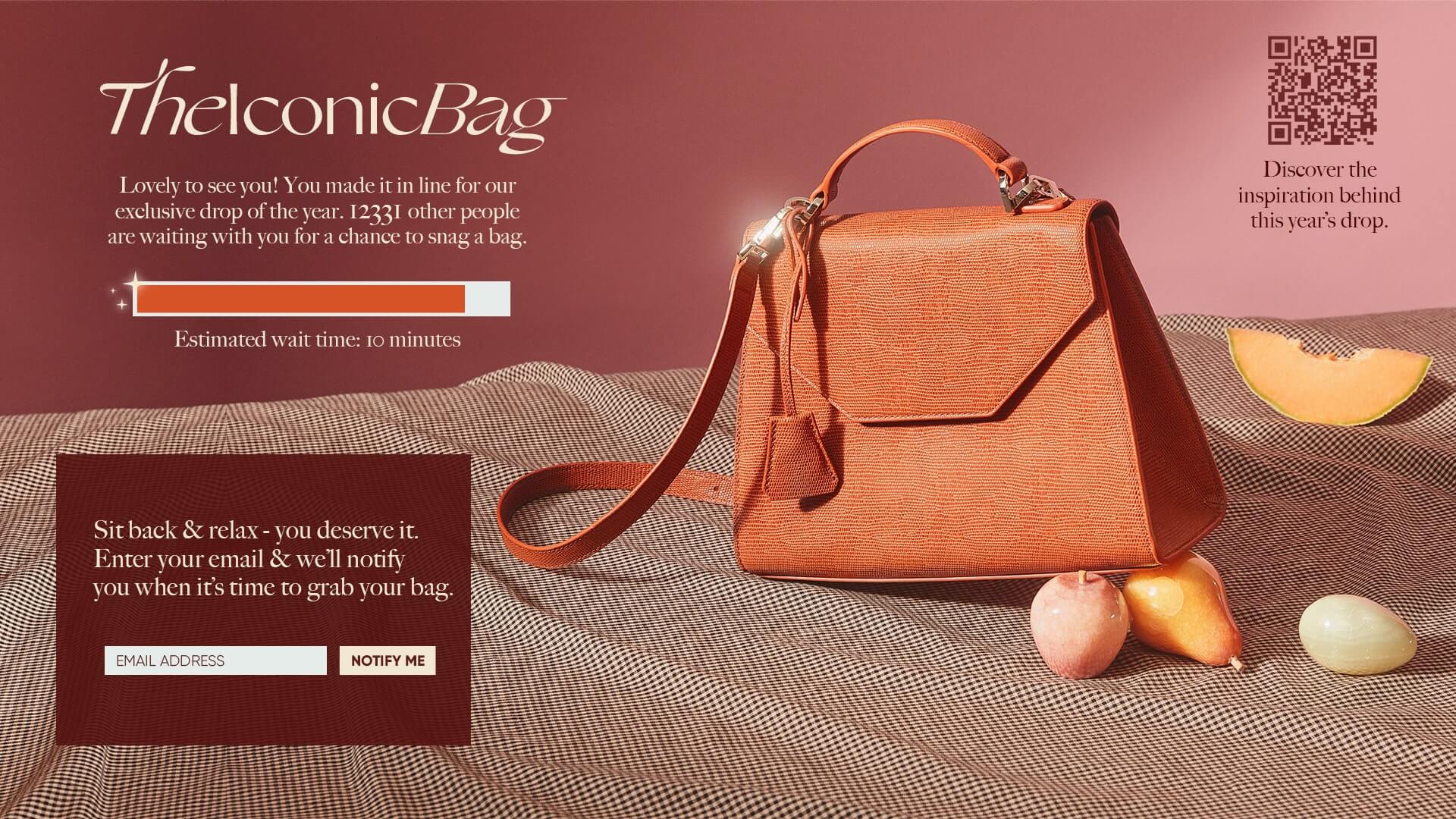

- Control traffic at the site level, page level, or in front of bottlenecks like payment gateways, database calls, and “Add to Cart” functions

- Throttle traffic outflow up & down depending on how your web app is performing

- Stay in control when visitor behavior doesn't match your load tested-expectations

"Queue-it’s a great bolt-on piece of infrastructure, completely dynamic to our needs."

Tristan Watson, Engineering Manager

"Having only one person to set-up the technology together with the Queue-it team saved us a lot of time, human resources, and money."

Robert Williams, Digital Manager

⭐️⭐️⭐️⭐️⭐️

CTO in Enterprise Retail

"Great customer support staff that respond back within minutes and are very knowledgeable. All around an amazing product and team."

Posted on G2

Posted on G2

⭐️⭐️⭐️⭐️⭐️

Admin in Apparel & Fashion

"Great product, better partner. The best part of using Queue-it has to be the dedicated, quick customer support."

Posted on G2

Posted on G2