Instead of their predicted decline, each new blockbuster seems to be bigger and sell faster than the last. As moviegoing morphs into a premium experience, pre-sales and online movie ticketing are increasingly vital to business strategy. With more mega-blockbusters around the corner, are you prepared to handle the surging demand and compressed ticketing timelines?

“Today there seems to be less demand for blockbusters than there is for focused or targeted content that isn't for everybody….the audience continues to move away from Top 40 music and blockbusters…” (Chris Anderson, 2006, The Long Tail: Why the Future of Business Is Selling Less of More)

When Anderson's Long Tail theory declared the demise of the blockbuster, it was heralded as idea of the year and a brave new world for business.

But in the wake of mega-blockbusters like Star Wars: The Force Awakens, Avengers: Infinity War, Black Panther, and now Avengers: Endgame, the truth of the Long Tail at the cinema appears less certain than ever.

Is the mega-blockbuster movie theater trend here to stay? Or, are these just extreme outliers hiding the true field of money-makers that don’t reach mega-blockbuster status?

What’s happening among the most popular movies has profound implications not only for the way movies are consumed but also how theater owners run their operations.

For owners, knowing whether a few mega-blockbusters will drive attendance moving forward guides strategy for everything from staffing to concessions stocking to online ticketing.

The tale of the Long Tail

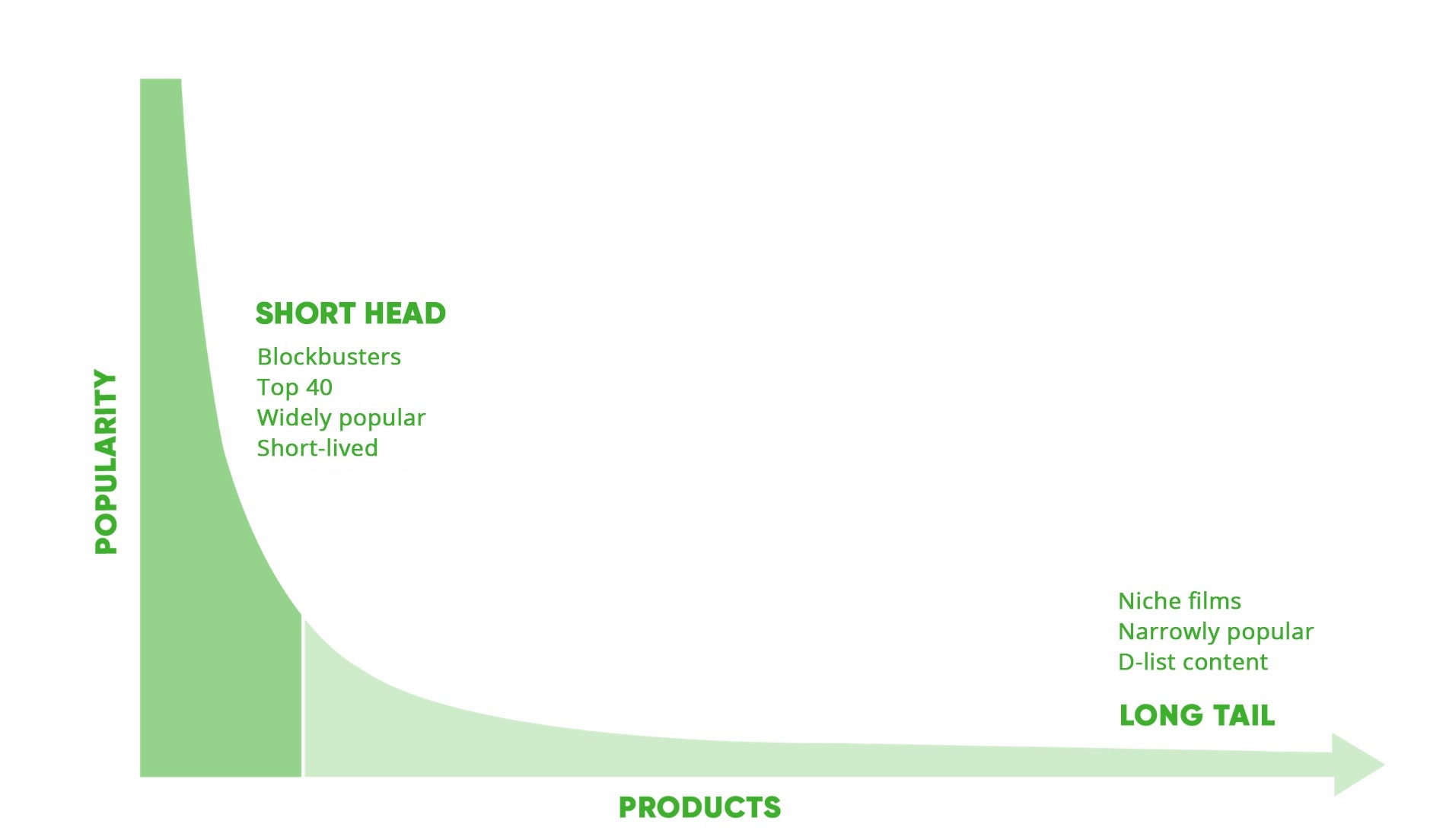

Long tail theory is named after the long tail that comes from charting the distribution of items (songs, movies, Google search terms) according to popularity.

Typically, the most popular items are outsized in their popularity. These are the hits we lavish praise and attention on. They win the awards. They make the top-seller lists. Everyone knows and talks about them.

Popularity quickly tapers off for the mass of non-hits, the “everything else”. And this tail can go on indefinitely.

Businesses, like the rest of us, might be so captivated by the hits that they overlook the business potential of the long tail. As Anderson put it,

“What if the non-hits—from healthy niche product to outright misses—all together added up to a market as big as, if not bigger than, the hits themselves?”

The Long Tail theory argues precisely that. Future business success depends on selling less of more.

Core to the theory is that we’re all unique, and until now haven’t been able to access the products that speak to who we truly are and what we genuinely enjoy. So, making products available to my niche, even if I’m one of very few who consumes them, is the better business strategy in the big picture.

For movies, then, should Hollywood move away from mass-appealing blockbusters and make more lower-budget films targeted to smaller audiences? Long tail theory would seem to say that’s what consumers want and that’s where success lies.

Avengers, mega-blockbusters & the surge of the short head

The tail is not bulking up but thinning out

Since the Long Tail theory came out, however, several studies have refuted its conclusions. Research by Anita Elberse of Harvard Business School found that instead of bulking up, the tail is becoming longer and flatter. Using video rental data, Elberse says that “the tail represents a rapidly increasing number of titles that sell very rarely or never.”

Consider that the last available data from Spotify shows that about 20% of songs—at the time, about 4 million—have never been listened to. Not even once.

The idea of all this music falling on deaf ears is so sad, someone created Forgotify, an algorithm that serves up never-before-heard songs. And how many songs are left with just one play to their credit?

…24%, if iTunes data has anything to say about it. Elberse found that of all tracks sold on iTunes in a given year, 24% sold only one copy. 91% sold fewer than 100 copies.

Instead of niche products slowly increasing in popularity, loads of products are hitting the market that have a tiny audience, if any at all.

For some businesses with models that keep catalog costs down, sales from the tail might add up to something substantial.

But this is clearly not an option for movies, with their high production and distribution costs.

Hits appeal to the masses

It feels nice to think that we each have unique taste, and once we find our niche, we’ll stick to it. But the film connoisseurs who watch obscure movies, it turns out, also watch more movies in general—including hits.

Mass-appealing blockbusters are just that—they appeal to a broad cross-section of society.

Elberse’s research shows that a customer that rented a popular movie would rent 20 other movies over a 6-month period. A customer who rented a niche movie would rent 50 over that same period.

Similarly, a 2018 study by Ernst & Young found an overlap in movie streaming behavior at home and movie theater attendance. The more movies people watched in the cinemas, the more the streamed movies at home, and vice versa.

In other words, the most active viewers are just going deeper into the niche films in the tail.

Enthusiasts of French New Wave will also watch most of the hit movies. At the same time, light consumers focus on the blockbusters.

A longer tail means a shorter head

In fact, the longer the tail, the shorter the head.

The more variety of products, the higher concentration of popularity among the biggest hits.

This flies in the face of long tail theory’s claim that blockbusters and hits are becoming less and less important for businesses.

Elberse’s data showed that the number of movie titles in the top 10% of weekly sales was more than cut in half over a five-year period. A select few movies were driving the top 10% of sales. As she says,

"The importance of individual best-sellers is not diminishing over time — it's growing."

A 2017 study out of the University of Pennsylvania’s Wharton School of Business also bears this out. For every additional 1,000 DVD titles, researchers found the top 1% of DVDs increased their popularity by 1.96%. The bottom 1% lost 21.29% of popularity.

The larger the offering, the more people gravitated to the blockbusters they know best.

No wonder the biggest earners of late have been remakes, reboots, or sequels.

A race to the box office

The movie industry has shifted towards the short head, leaving the small and medium studios to struggle with the long tail.

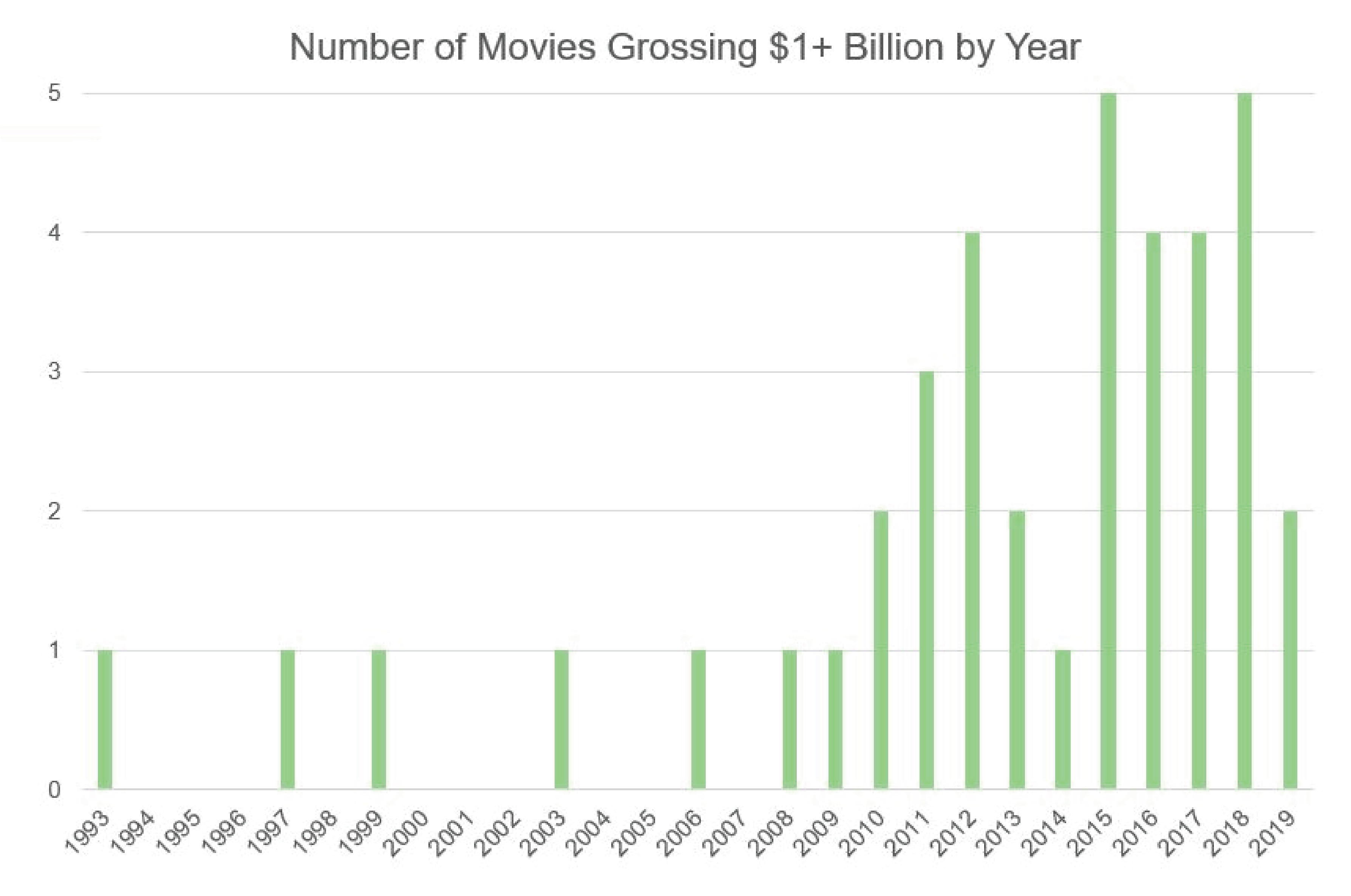

As the mega-blockbuster asserts its dominance, each year seems to bring a new box office record. In the history of film, 39 movies have grossed over $1 billion. 33 of those films are from the last 10 years!

Source: Box Office Mojo

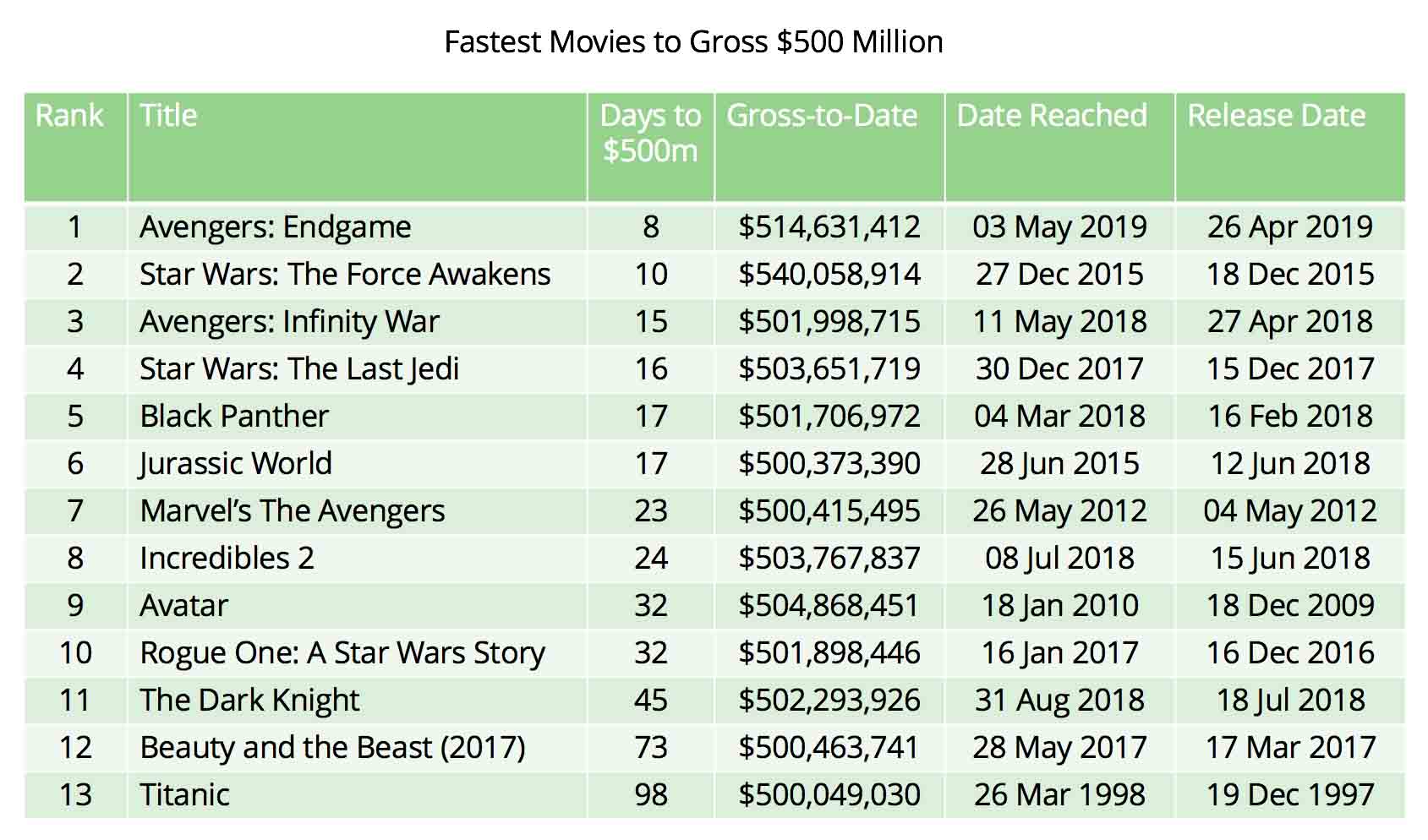

And look at how quickly these mega-blockbusters are selling tickets.

Below is a chart of the time it took films to gross $500 million.

Titanic took 98 days to reach $500 million. Avengers: Endgame did it in just 8.

Source: Box Office Mojo

Okay, you say. This could just be a factor of increasing ticket prices. I’m not impressed. Give me something more.

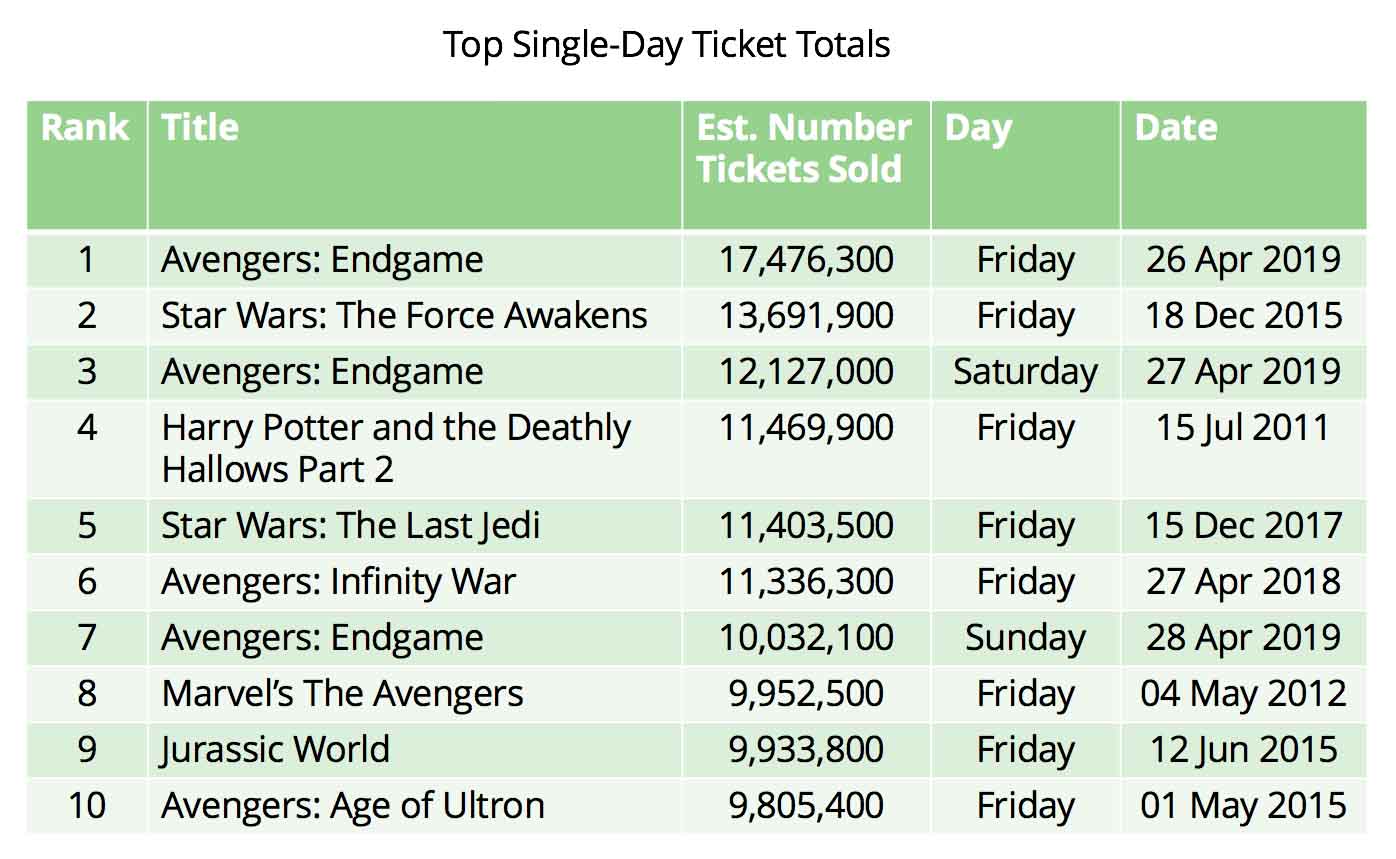

So, let’s look at the number of tickets sold.

Of the 120 top all-time single-day ticket totals, all 120 are from the past 25 years.

Avengers: Endgame takes spots 1, 3, and 7 for its first Friday, Saturday, and Sunday showings. The 17.4 million estimated tickets trounced the 13.6 million of the 2015 Star Wars franchise reboot.

Impressive, especially considering that the number of movie tickets sold in North America, the world’s biggest cinema market, has fallen 17% since its peak of 1.575 billion in 2002.

Source: Box Office Mojo

This race to the box office is undoubtedly a movie theater industry trend of our time. And these single-day records will probably already be outdated within a year.

There’s a reason it’s called the short head, not the tall head. The reign of the few successful hits is often short-lived. There’s always a bigger hit coming soon to a theater near you.

Reasons behind the race to the theaters

What’s behind the mad dash to these mega-movies? There are several possibilities.

Emotional continuity

We all know intuitively—and film researchers have found—that movies are emotion machines. With reboots, remakes, and sequels, moviegoers get emotional continuity. Films tug at the heartstrings as we get attached to characters and narratives. Some may conjure up nostalgia for childhood.

As one Avengers moviegoer told the Wall Street Journal: “It’s like part of the family when you see Tony Stark up there.”

The watercooler effect

Humans are social creatures. We love to feel we’re part of something bigger.

The buzz that surrounds a shared cultural event is known as the “watercooler effect”. We’re loath to feel that we’re missing out on a cultural phenomenon, especially within our peer groups.

The effect isn’t new. But it’s moved far beyond the watercooler.

As technology has increased our interconnectedness, we’re able to have cultural discussions in many ways in real time. The internet and social media key us in even more to the activities of our peers.

We use platforms to track and rate movies we watch for our friends to see. We “check in” to movie theaters on Facebook to show that we’re part of the larger experience and deserve a part in the cultural conversation.

The fear of missing out, of being left out of the conversation, is more real now than ever.

The spoiler machine

With social media’s real-time connectedness, spoilers are everywhere.

As we write this blog, the final Game of Thrones season is out, and our poor social media manager is distraught after being served with spoiler after spoiler just trying to do her job.

The only way to avoid spoilers without disconnecting from social networks is to see the movie as soon as it comes out. And that can only be done in theaters. This too contributes to the race to the cineplex.

4 pivotal trends every movie theater operator needs to know

1. Movies are becoming an experience

A few decades ago, going to the movies was a form of recreation in and of itself. You might look up a movie and time in advance but have to pick a new movie when you arrived and realized only the front row seats were left. You also might just choose a time and go whatever movie was playing in the local theater at that time.

Whether due to competition from home streaming options, or something else, moviegoing seems to have shifted to become a more deliberate process. Consumers are choosing theatrical moviegoing as an intentional, product-specific entertainment option.

No wonder luxury experience theaters have been proliferating these days.

In the theaters, we see IMAX and 3D screens (and their accompanying surcharges) with advanced sound systems. This gives the auditorium something audiences can’t replicate at home. Plush recliners and fancier interiors add to the idea of an experience worth splurging on.

And why not bring the classic “dinner and a movie” night all under one roof? Increasingly, theaters are featuring high-class concession stands with dinner, wine, and craft beers.

Or want to take the kids out? Some California chains have converted the auditorium into a kid-friendly play area for before and after the show.

In a way, movie theaters are just following the trend in physical retail to move upmarket and turn themselves into destinations. Simultaneously they are emulating the “entertainment experience” of a concert.

2. Online ticketing means premiumization of the theatrical experience

If consumers increasingly see the cinema as an “experience” similar to a concert, it would also make sense that buying movie tickets becomes similar to buying concert tickets. No more rolling up the box office a couple minutes before showtime.

And just like concertgoers customize the experience during ticketing—think premium seat selection or VIP access—online purchasers of movie tickets are increasingly moving towards a premiumization of the theatrical experience.

In a 2018 U.S. study, compared with in-theater ticket buyers, online ticket buyers:

- Were over 2x as likely to buy a meal or alcoholic beverage

- Were 1.8x more likely to opt for premium 3D screens

- Opted for premium seating 60% of the time, compared with 38% of in-theater buyers

People who purchased their tickets deliberately (online) treat their cinema visit as a premium experience. These customers are a boon for movie theater operators.

3. Successful online pre-sales are vital to business strategy

Movie theaters are taking another page from concert ticketing—marketing-led pre-sales weeks that take place weeks before the actual event. The start of the Avengers: Endgame pre-sale was on par with the hype surrounding something like the drop of Beyoncé tour tickets.

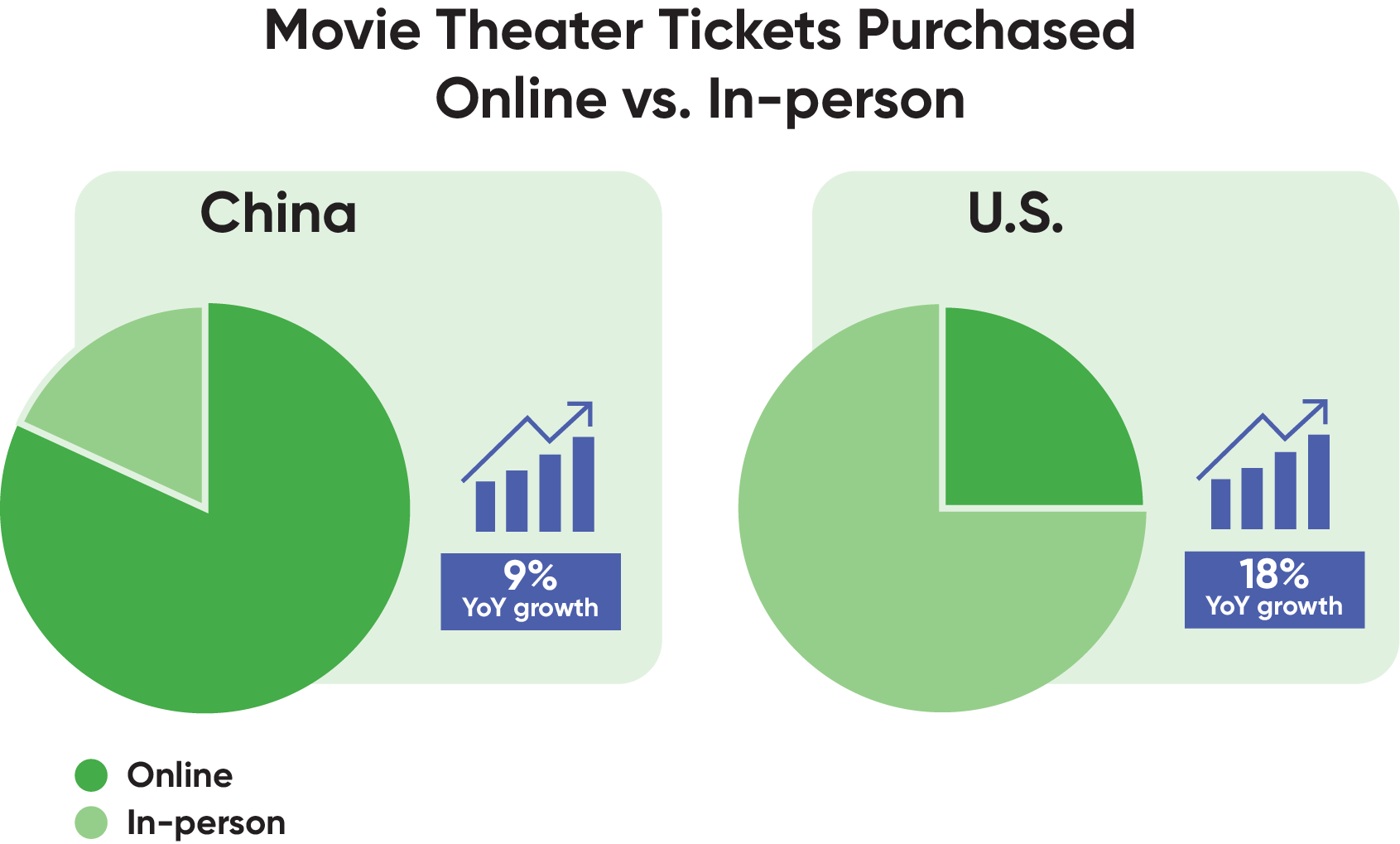

In many countries online movie ticket booking is already the norm.

Sources: China Film Insider, Webedia Movies Pro and Vertigo Research

In China, the world’s 2nd largest film market by box office revenue, online has already taken over 80% of cinema ticket market share.

The U.S. lags behind, with about 25% of tickets purchased online in 2018, a figure that grew 18% year-over-year.

For the hyped mega-blockbusters, however, the pre-sale is king. And this happens all online.

For example, Avengers: Endgame took just six hours for Fandango and half a day for Atom Tickets to break the companies’ best first-day ticket sale records.

Fandango later announced that during the first week of online pre-sales they sold 5 times as many tickets for Avengers: Endgame as they did for Avengers: Infinity War just the year before.

Pre-sales generate massive revenue, and also allow theaters to add extra showings as needed, fine-tuning supply and boosting the bottom line.

Source: Fandango

4. A compressed timeline puts exponential demand on capacity

We've seen how and why mega-blockbusters are selling more tickets earlier than ever. Where theater operators will most acutely feel this is in their online ticketing platforms.

Squeezing the timeline puts an exponential growth demand on the capacity of ticketing infrastructure.

Take a look at the extreme traffic peak one of our customers experienced during a recent mega-blockbuster pre-sale, shown in new users per minute entering the ticketing flow:

And it's not enough to focus on website alone.

Mobile is increasingly the driver of online movie ticket booking worldwide, and by one estimate has already outpaced desktop in North America. Any IT strategy needs to reflect this reality.

There are certainly many ways to build performance into a website to try and handle the web traffic load. But the massive demand can crash even an optimized system.

Several leading cinema chains—just like major ticketing platforms Ticketmaster and AXS—have had success by implementing a virtual waiting room.

For Avengers: Endgame, while some online movie ticketing systems were unable to handle the load as their services crashed, Fandango was able to manage the surging traffic volume through the use of a virtual waiting room.

Virtual waiting rooms mitigate the enormous traffic surge to ticketing infrastructure by placing excess visitors into an online queue with customizable queue page.

The best virtual waiting rooms offer native mobile app integration to meet online movie ticketing demand where it is. And they offer a pre-queue option to collect visitors who arrive early, preventing crashes before the sale even starts.

Managing traffic inflow to the entire customer journey has the added benefit of making sure payment gateways and other external bottlenecks don’t become overloaded.

As Charli Bregnballe, CTO of Danish online movie ticket service Kino, puts it, without their use of a virtual waiting room:

“The site would crash every time during presales, resulting in a huge loss of revenue. We scaled up the servers quite a lot, which was extremely expensive, and it didn’t help. Plus, it didn’t ensure that our integrated ticketing and payment systems wouldn’t crash. If we don’t use a virtual waiting room, we cannot run presales for blockbusters like Star Wars and Fifty Shades of Grey. It’s a business necessity.”

Record-breaking blockbusters are around the corner

As the short-lived Short Head tells us, we should already be looking ahead to the next movies poised to challenge Avengers: Endgame.

Disney has a major lineup of remakes and sequels coming up this summer, including Aladdin, Toy Story 4, and The Lion King.

Looking ahead, the studio has also announced Avatar and Star Wars sequels to be released each year from 2021 through 2027.

These are just a few mega-blockbusters poised to break new revenue and attendance records at theaters around the world. And along with them will come exponential demand on online movie ticket booking.

After Avengers: Endgame, are you doing whatever it takes to prevent your ticketing system from crashing?