109 Staggering Singles’ Day facts every retailer should know in 2023

There’s no denying it: Singles’ Day is on the rise. Every year brings more companies, more countries, and billions more into its fold. What started as an “Anti-Valentine’s Day” and a celebration of singledom has transformed into the biggest ecommerce shopping day of the year. Here’s what you need to know about the day known as Double Eleven: its origins, its present-day stats, and the trends shaping its future.

Table of contents

- What is Singles' Day?

- When is Singles' Day?

- Who created Singles' Day?

- Singles' Day grows 10,000x in 13 years

- Singles' Day sales statistics

- Singles' Day shopping statistics

- Single's Day statistics by ecommerce platform

- Singles' Day technology & trends

- Singles' Day global statistics

- Singles' Day website issues

Singles’ Day is the world’s biggest shopping event, with sales estimated at $157 billion USD (1.1 trillion yuan) in 2022.

For a sense of scale, ecommerce giant Alibaba’s gross merchandise volume (GMV) during Singles’ Day 2022 was approx. $84.5 billion USD. That’s over 6 times the global GMV from Amazon’s Prime Day and almost 10x what U.S. consumers spent online across all retailers during Black Friday 2022.

Dubbed “Anti-Valentine’s Day”, Singles’ Day is a celebration of single people across China, and increasingly, the world.

RELATED: 115 Black Friday Statistics Every Retailer Needs to Know in 2023

Singles’ Day falls every year on November 11. It’s known as 11.11, Double Eleven, or “bare sticks holiday” because of how it looks numerically, consisting of four lonely ones.

But Singles’ Day has expanded in recent years, with presales now starting in late October, and promotions running through to Nov. 11.

Singles’ Day was created in 1993 by students from Nanjing University who wanted to claim their own Valentine’s Day for singles. From there, the celebrations quickly spread beyond the university, becoming widely recognized across China.

Alibaba, China's largest retailer and ecommerce company, embraced Singles’ Day in 2009. The company saw it as a chance to boost sales between China’s Golden Week national holiday (the first week of October) and Christmas.

China’s Singles’ Day sales, now officially called the 11.11 Global Shopping Festival, has skyrocketed in popularity over the last decade.

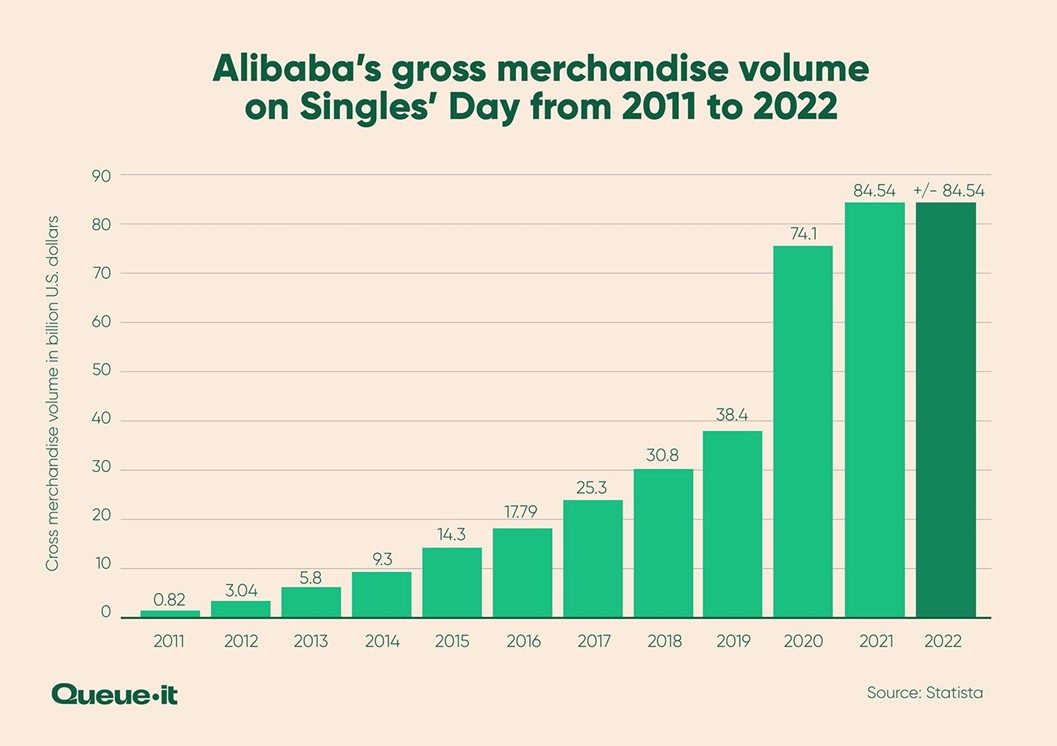

In 2009, Alibaba’s first Singles’ day sales event included 27 brands, generating a gross merchandise volume (GMV) of $7.8 million USD or 50 million yuan.

By contrast, Alibaba’s 2021 Singles’ Day GMV hit an all-time high of $84.54 billion USD. That’s up over one million percent (1,083,746%), or 10,000x in just 12 years, with an 8% increase from 2020.

2022 was the first year in Singles’ Day history Alibaba declined to release its sales data, with the company simply stating sales were “in line” with those of 2021.

Alibaba rival JD.com (China’s second-largest retailer) also declined to release sales numbers for the first time—although they called their sales “record-setting”.

Estimates put Alibaba’s Singles’ Day sales growth in 2022 at between 0.9% and 3.6% YoY.

This pales in comparison to the 86% growth Alibaba experienced between 2019 and 2020, but remains an impressive result in a year marred by economic uncertainty, COVID-19 restrictions, and anti-monopoly action by the Chinese government.

Singles’ Day 2022 had over 290,000 brands participating, of which 70,000 were participating for the first time. Estimates put the number of discounted products at a massive 17 million (up from 14 million in 2021), and the number of Chinese participants at over 900 million.

China’s big retailers declined to release their Singles’ Day revenue in 2022, so we have to rely on estimates:

1. Consultancy Syntun estimated 2022 Singles’ Day shopping events totaled $128.42 billion USD (934 billion yuan) in sales, up 2.9% YoY.

2. Xingyun Data claims overall Singles’ Day sales in 2022 hit $151.2 billion (1.1 trillion yuan), which would represent a 13.7% year-on-year increase.

3. Citi analysts forecasted Alibaba's gross merchandise volume (GMV) for the event to range from $75 billion to $77 billion (545 billion to 560 billion yuan), which would represent growth of between 0.9% and 3.6% YoY.

4. China’s National Bureau of Statistics showed the total retail sales of consumer goods were down 0.2% year-on-year in 2022.

Singles’ Day 2022 sales volume across all platforms was between $128 and $151 billion, an increase of between 2.9% and 13.7% from 2021.

5. Chinese logistics companies handled a daily average of 389 million parcels during 2022’s 11.11 shopping festival, compared with roughly 425 million per day in 2021.

6. Beauty remained among top product categories in terms of GMV for Singles’ Day with over $4.7 billion (34 billion yuan) in sales in 2022—although this represents a 7.7% decrease YoY.

The number of daily active ecommerce platform users by platform during Singles’ Day 2022 was:

7. Pinduoduo: 576 million

8. Taobao: 527 million

9. JD.com: 192 million

10. 2022 was the first time in history Pinduoduo overtook Alibaba’s Taobao for no. of daily active users

11. But no. of users doesn’t equate to revenue—Tmall accounted for almost 5% of all GMV during Singles’ Day 2022, while Pinduoduo accounted for around 6.4%.

12. Chinese consumers spent an average of $38 per order (272 yuan) during 2021's Singles' Day sales.

13. China’s Gen-Z consumers accounted for 31% of the total Singles’ Day spend in 2021. Those over 40 accounted for just 23% of total sales.

14. Only 8% of new Singles’ Day participants came from “lower tier” Chinese cities in 2022—down from 12% in 2021. (The city tier system is frequently used to segment the large Chinese market. Tier 1 describes the largest and most developed cities like Beijing and Shanghai. Other tiers characterize cities with smaller populations with typically less affluent consumers. Singles’ Day growth is traditionally driven by consumers in “lower tier” cities).

15. 34% of shoppers who took part in Singles’ Day in 2021 and planned to do so again in 2022 said they would spend less in 2022.

16. Only 24% of consumers said they’d spend more on Singles’ Day sales 2022.

17. 69% of consumers said they would shop Singles’ Day sales across three or more platforms in 2022—up from 56% in 2021.

18. 37% planned to use five or more platforms in 2022.

19. Adult consumers in China planned to increase their spending during 2022 Singles’ Day in 9 out of 11 product categories.

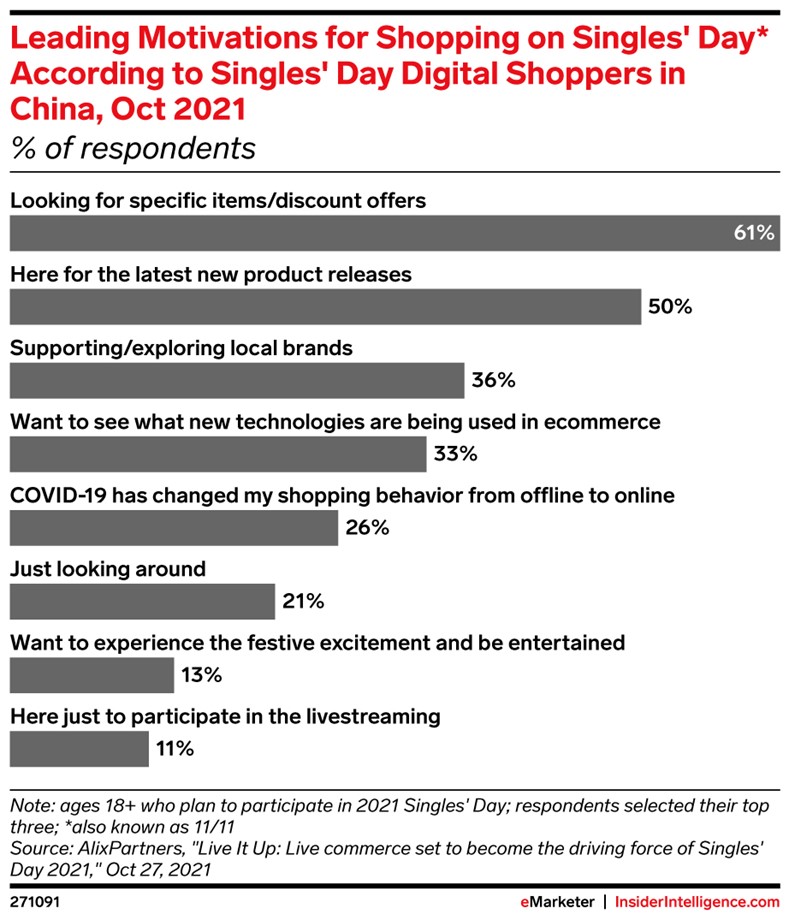

20. The top motivations for shopping Singles' Day sales in 2021 were: specific disounts/offers, new product releases, and supporting/exploring local brands.

21. Alibaba’s Tmall marketplace offered Singles’ Day sales on over 17 million products in 2022, up 3 million from 2021.

22. A record 290,000 brands from over 90 countries participated in Tmall’s Singles’ Day sales in 2022.

23. Products were sold across 7,000 product categories.

24. Approximately 70,000 brands took part in Tmall’s Singles’ Day sales for the first time in 2022, including luxury houses Bulgari, Moncler and Brunello Cucinelli.

25. Sales of some high-tech beauty devices on Tmall surged 5,570% from last year.

26. In the first hour of sales on October 31, 2022, Tmall saw turnover of 102 brands exceed $13.8 million (100 million yuan).

27. Over 33 million consumers purchased eco-friendly products on Tmall and Taobao during 11.11 sales in 2022.

28. Alibaba offers several loyalty programs, including its 25-million-strong 88VIP ecosystem-wide club whose members spend on average $8,000 annually.

29. In 2022, Alibaba used the 88VIP loyalty program to give members early access to sales, exclusive access to products, and steeper discounts than regular consumers.

RELATED: 79 Staggering Statistics That Show The Power of Loyalty Programs in 2023

30. On Nov. 1, 2022, 82 brands surpassed $13.75 million (100 million yuan) in GMV generated from loyalty members on Tmall—including Nike, L’Oreal, The North Face, and Estee Lauder.

31. Over 130 brands made $13.75 million (100 million yuan) from loyalty members between 8pm and midnight on Nov. 10, 2022.

Alibaba's 88VIP loyalty program has over 25 million members with an average annual spend of $8000.

32. Sales on Tmall of premium skincare brands enjoyed compound annual growth of 52% between 2019 and 2021. This implies it more than doubled between 2019 and 2022, compared with just 16% growth for mass-market brands, says McKinsey.

33. In 2021, Alibaba’s Tmall accounted for 57.59% of all Singles’ Day sales, making $84.5 billion across the period and growing 8% YoY.

34. Second only to Alibaba is Jingdon (JD or JD.com) which accounted for 27.06%—$54.6 billion—of the 2021 Singles’ Day sales and increased its transaction volume by 28.6% year-over-year.

35. Top 5 skincare brands on Tmall in 2022 were L'Oréal, Estée Lauder, Lancôme, Olay, and Proya, and on JD.com the ranking was Lancôme, Estée Lauder, SK-II, Helena Rubinstein and L'Oréal.

36. Top 5 makeup brands on Tmall in 2022 were MAC, 3CE, Florasis, YSL, and Estée Lauder, and on JD.com, the ranking was YSL, Dior, Chanel, Estée Lauder, and Clé de Peau Beauté.

RELATED: How aCommerce & L’Oréal Deliver a Fairer Shopping Experience

L'Oréal's Singles' Day livestreams on Alibaba's Taobao

37. Although JD.com declined to release sales data, they stated sales were “record-breaking” in 2022.

38. JD said Apple sold over $140 million (1 billion yuan) worth of products in the first minute of the Singles’ Day 2022 final sales period (the last 28 hours of sales from Nov. 10 to Nov. 11).

In the first 10 minutes of JD's 2022 “final sales” period:

39. Transaction volumes of gaming TVs, Air conditioners, and self-cleaning robots increased 100% YoY.

40. Transaction volumes of XR glasses and XBOXs on JD.com increased 3x.

41. Transaction volumes of top fashion brands from the LVMH group, including BVLGARI, CELINE, FENDI, and LOEWE increased 18 times.

42. Transaction volumes for 87 international beauty brands tripled—including Estee Lauder, L’Oreal, and L’Occitane.

43. JD’s price guarantee service—which guarantees customers get the lowest price in a 30-day period regardless of when they purchase—was clicked over 500 million times during the 2022 Singles’ Day period.

44. JD provided almost 20 million new items during Singles’ Day 2022, of which half achieved a month-on-month growth of over 200%.

JD.com had almost 20 million new products on offer for Singles' Day 2022.

45. JD said the best-selling new products included cell phones, laptops, washing machines, refrigerators, and flat TVs.

46. 63% of all new JD customers in 2022 were under 35 years of age.

RELATED: 90 Cyber Monday Statistics Every Retailer Needs to Know in 2023

47. Average basket size from lower-tier market consumers increased 12% YoY.

48. In the first 28 hours of Singles’ Day 2022 sales, the transaction volumes of 50k small-to-medium sized (SMB) brands and 70k SMB merchants increased 100%.

49. Over 200k physical stores launched on JDDJ Shop Now—which offers on demand retail with delivery in one-hour—more than double in 2021.

50. Over 1,600 nutrition brands doubled their YoY transaction volume on JD.com.

51. Keyword searches surged in 2022 for green topics like “energy-saving”, “low-carbon”, “organic”, and “green” on JD.com.

52. JD Home Appliances trade-in services grew seven-fold YoY—meaning 20% of all home appliance orders in 2022 were placed with a trade-in of an old appliance.

Shoppers embraced “China-chic”—the Gen Z phenomenon of shopping product made in China by Chinese brands—on JD.com in 2022:

53. The amount of China-chic products increased 99% over the past 4 years.

54. Brands under the category China-chic have grown by 68%.

55. Sales for China-chic products have grown 284%.

56. 299 cosmetic brands grew transactions 10x YoY in 2022 on JD.com.

57. And 952 cosmetic brands doubled their transactions

58. 79% of JD.com consumers expressed strong interest specifically in new products in 2022.

59. The transaction volume growth of JD’s new products was consistently faster than the overall growth in the product category.

Staff at JD Pharmacy fulfilling Singles' Day orders

Douyin is the Chinese (and original) version of the short-form video app TikTok. The app only released ecommerce functionality in 2020, but it’s become the fastest growing location to shop Singles’ Day ecommerce sales.

60. Douyin launched commerce functionality in 2020, and GMV increased 9% year on year on the first day of Double 11 this year.

61. The number of participating merchants on Douyin increased 86% year on year, with both local and global beauty brands activating their flagship stores on Douyin, according to Iris Chan, Digital Luxury Group's Head of International Client Development.

62. The total sales generated by short video platforms Douyin and Kuaishou was almost $25 billion (4 billion yuan) in 2022, an increase of 146.1% over the same period last year.

63. The cumulative hours of live commerce streaming on Douyin increased by 50% YoY during Singles’ Day 2022—they totaled 38.21 million hours of watch time.

64. 7,667 live streams on Douyin brought in over $140,000 (1 million yuan) in sales in 2022

65. Syntun estimated newer streaming ecommerce platforms and community group buying retailers saw around $24.89 billion (181 billion yuan) in sales in 2022.

Shoppers watched over 38 million hours of livestreams on Douyin during Singles' Day 2022.

At any given time, there are hundreds of livestreams running across the Singles' Day shopping period

Livestreamed shopping, also known as live commerce, has been one of the most successful sales delivery methods in China since Alibaba pioneered the trend in 2016.

Live commerce is a Singles’ Day sales staple. It combines ecommerce with entertainment through major celebrities, live giveaways, exclusive discounts, and 24-hour streaming across the whole Singles’ Day sales period.

Here are the stats:

66. Farm livestreams were breakout stars in Singles’ Day 2022, with over a million people watching a 37-year-old chestnut farmer livestream her produce.

67. The gross merchandise value of over 46,000 agricultural products—from cu-cumbers and carrots to apples and cherries—purchased during the Singles’ Day 2022 more than doubled YoY.

68. Around 16.64 million platform users bought up 35.49 million agricultural products in the first two weeks of Double 11 sales 2022.

An apple farmer from Sichuan province who participated in Taobao's "One More Agricultural Product" program during 11.11

69. Taobao (Alibaba’s livestream platform) recorded 684% YoY growth in pre-sale volumes generated by new livestreaming hosts in the first four hours of pre-sales.

70. $11.8 billion USD (73.8 billion yuan) was spent on live commerce platforms during 2021 Singles’ Day sales.

71. Top Chinese influencers Austin Li and Viya drove $2.9 billion in sales across their 12-hour livestreams in 2021. Li’s stream alone attracted 250 million viewers.

72. 11% of Chinese consumers planned to participate in Singles’ Day just to watch the livestreams in 2021.

73. 88% of respondents from first-tier cities planned on spending via livestream shopping during Singles’ Day sales in 2021. For comparison, 79% of respondents from tier-3 and tier-4 cities planned to use livestreamed shopping.

74. One 2022 survey found 77% of Chinese shoppers have purchased products using live commerce. For comparison, just 22% of Australian shoppers have used live commerce.

75. Users of live commerce spent an average of 9 minutes per day on Taobao across Singles’ Day sales in 2021, compared to 28.3 minutes for non-users.

76. Benedict Cumberbatch participated in 2021’s Singles’ Day livestreams to give clues about a mystery box. He joins Singles’ Day Western celebrity livestream alumni Katy Perry, Kim Kardashian, Miranda Kerr, and Taylor Swift.

77. Alibaba’s Taobao Live had 28 livestreaming channels in 2020, with real-time translation in four languages. As a result, Taobao Live saw 2020 pre-sales exceed 2019’s entire first day of pre-sales in just the first 10 minutes.

77. Cainiao deployed an army of robots to cover last-mile leg work on some 400 university campuses in China during 11.11

78. The 700-strong fleet of Xiaomanlv (“Little Donkey” in Mandarin) automated guided vehicles has doubled in size from last year’s festival and received support from a network of pickup stations to serve customers in hard-to-reach areas.

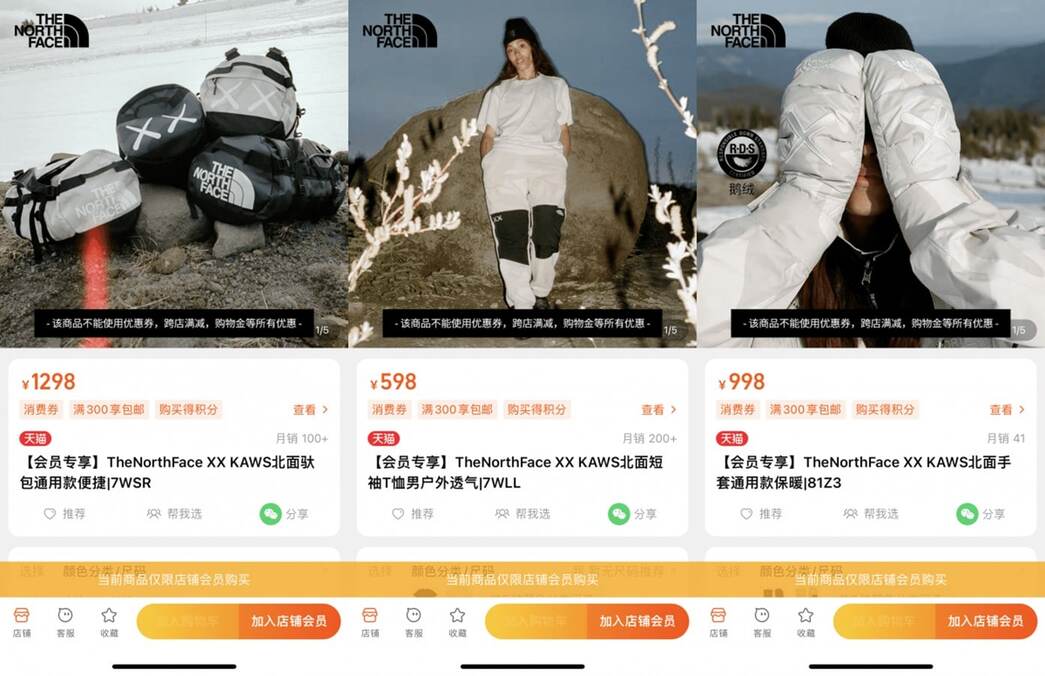

80. Many brands used Singles’ day as a chance to drop exclusive limited-edition products and capsule collections, including:

-

- Burberry: which launched a wool scarf exclusively for Tmall shoppers

- Vans: which released limited-edition shoes

- The North Face: which partnered on an exclusive line with artist KAWS

RELATED: Everything You Need to Know About Product Drops: Strategies, Benefits & Examples

81. Alibaba launched a virtual shopping mall for 11.11 2022 where shoppers browsed over 700 products through the eyes of customizable avatars and checked out purchases in virtual shopping carts.

82. Virtual influencers have exploded in popularity from roughly nine globally in 2015 to over 200 in 2022.

83. In China, the virtual idol influencer industry has more than doubled between 2019 and 2021.

This was seen in the prominence of 2 breakout computer-generated Alibaba influencers called Ayayi and Noah during the 2022 Singles’ Day sales:

84. Virtual influencer Ayayi has over one million social media followers.

85. Ayayi has partnered with over 30 high-end brands, including Louis Vuitton, Burberry, Porsche, and Prada, for marketing campaigns in China.

86. Ayayis’ male counterpart Noah was created based on the votes of over 21,000 Chinese consumers, who chose his personality, skills, and appearance. This resulted, Alibaba says “in a cool male model with dark hair who can dance like a K-pop star”.

87. Noah ran a livestream for Tommy Hilfiger, where he spent over an hour chatting to customers and dancing. The livestream was viewed by 670,000 people and the brand's GMV from livestreams during the hour quadrupled.

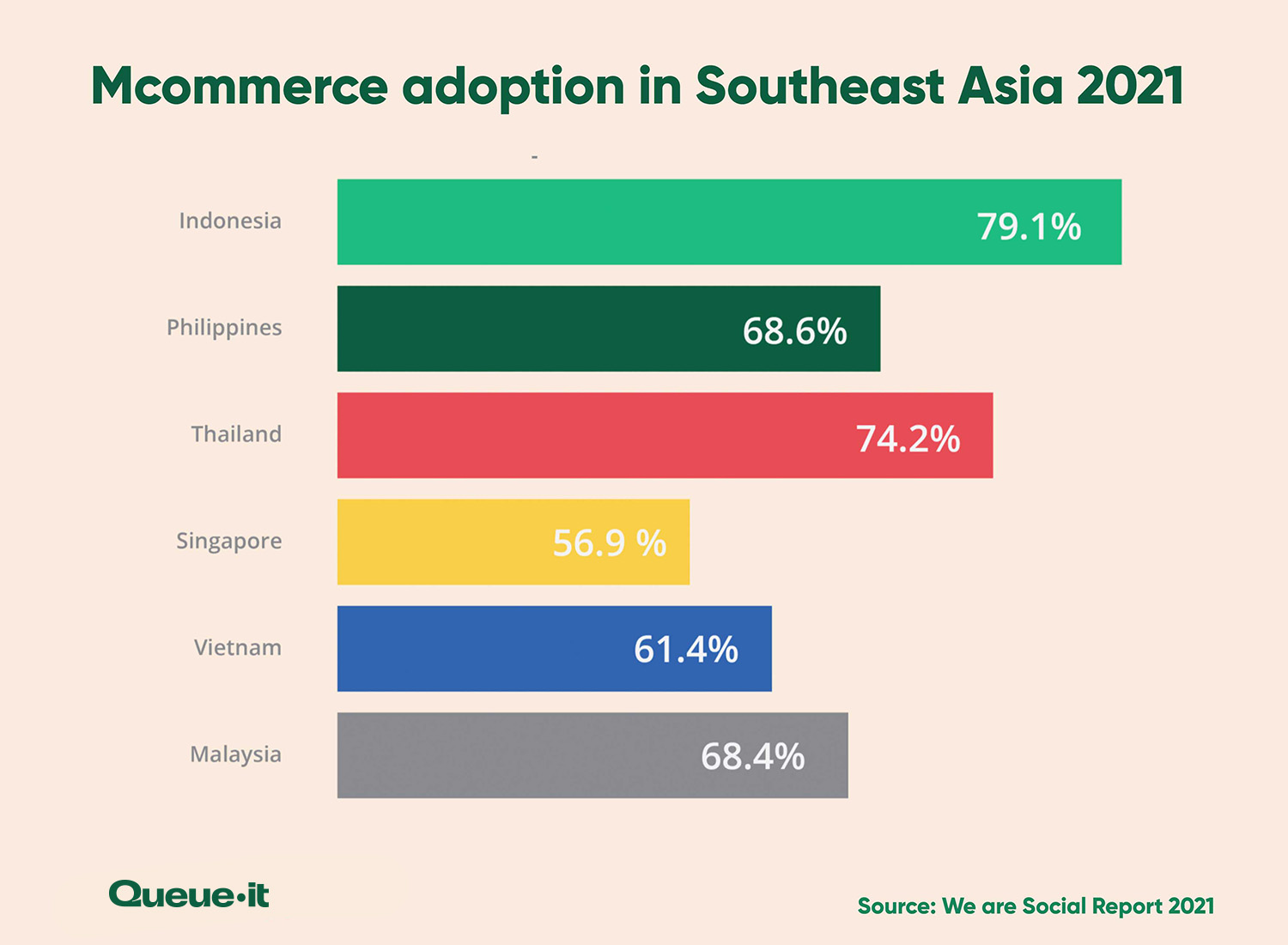

The Southeast Asian and Chinese markets have been ripe for a shopping celebration like Singles’ Day for several reasons. The population is growing, the middle class is emerging with an increasing disposable income, and affordable smart phones are accessible throughout the region.

Mobile, in particular, has been a driving force behind sales during the 11.11 Global Shopping Festival.

89. In 2022, mobile commerce accounted for over half of all ecommerce sales in all surveyed Asia-Pacific countries—the only exception was Japan, where it was 39%

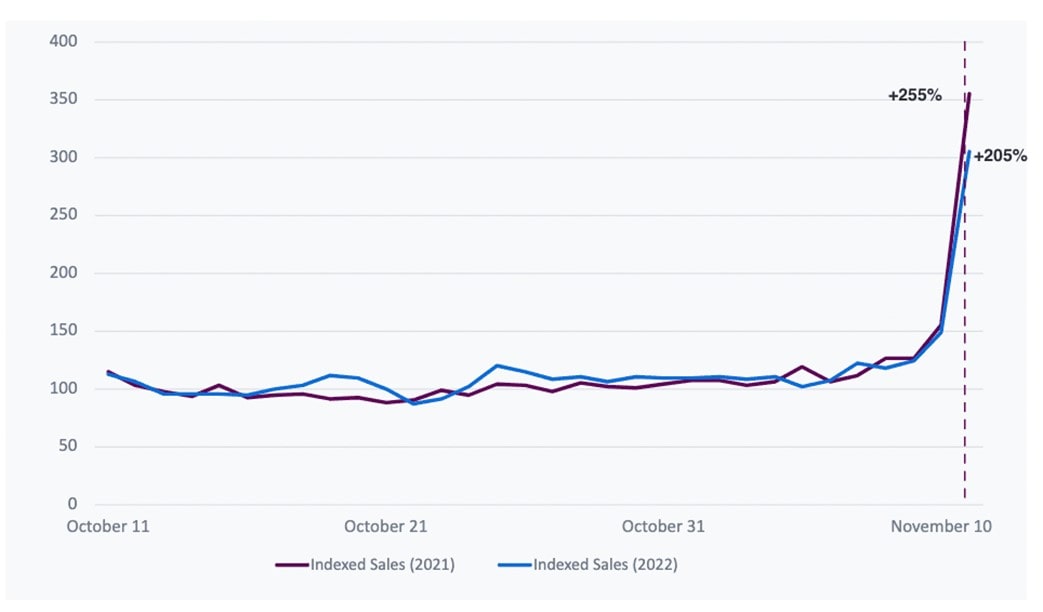

90. Across Southeast Asia, sales increased 205% on November 11 compared to October 11-17.

Looking at the data by country, Singles’ Day sales (compared to a similar period in October) increased by:

91. 263% in Singapore

92. 131% in Indonesia

93. 79% in Vietnam

Year-over-year indexed sales from Southeast Asian retailers Oct. 11 to Nov. 10. (Source: Criteo)

Looking at purchases by device category in the Asia-Pacific region, apps saw the biggest jump on Singles’ Day 2022, compared to October:

93. App purchases increased 234%

94. Desktop purchases increased 231%

95. Mobile purchases increased 189%

96. A recent report found 69% of Southeast Asians are now on the internet, with mobile connections from the region exceeding 887 million.

97. The region’s internet economy is expected to surpass USD $50 billion by 2025, exceeding earlier estimates of growth.

98. A 2020 survey found Singles’ Day was the most anticipated sales event of the year in Malaysia.

99. In China, the home of Singles’ Day, 940 million individuals (65.2% of the population) are active internet users. 877.8 million of these users access it through mobile. That’s 93.4% of the country’s total user base.

Mobile is a key player in Singles’ Day ecommerce, an astonishing find given mcommerce penetration across Asia has yet to hit its full potential. And with 2023 reshaping the retail landscape, we can expect to see new mobile trends, commerce, advertising, and video dominate the digital economy in the years to come.

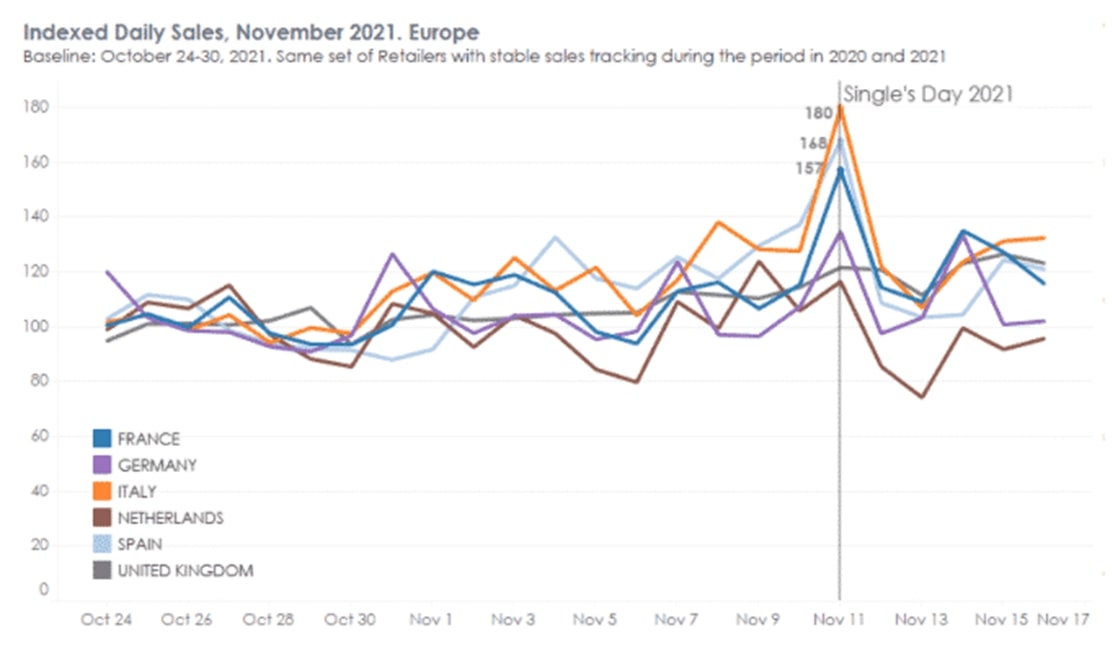

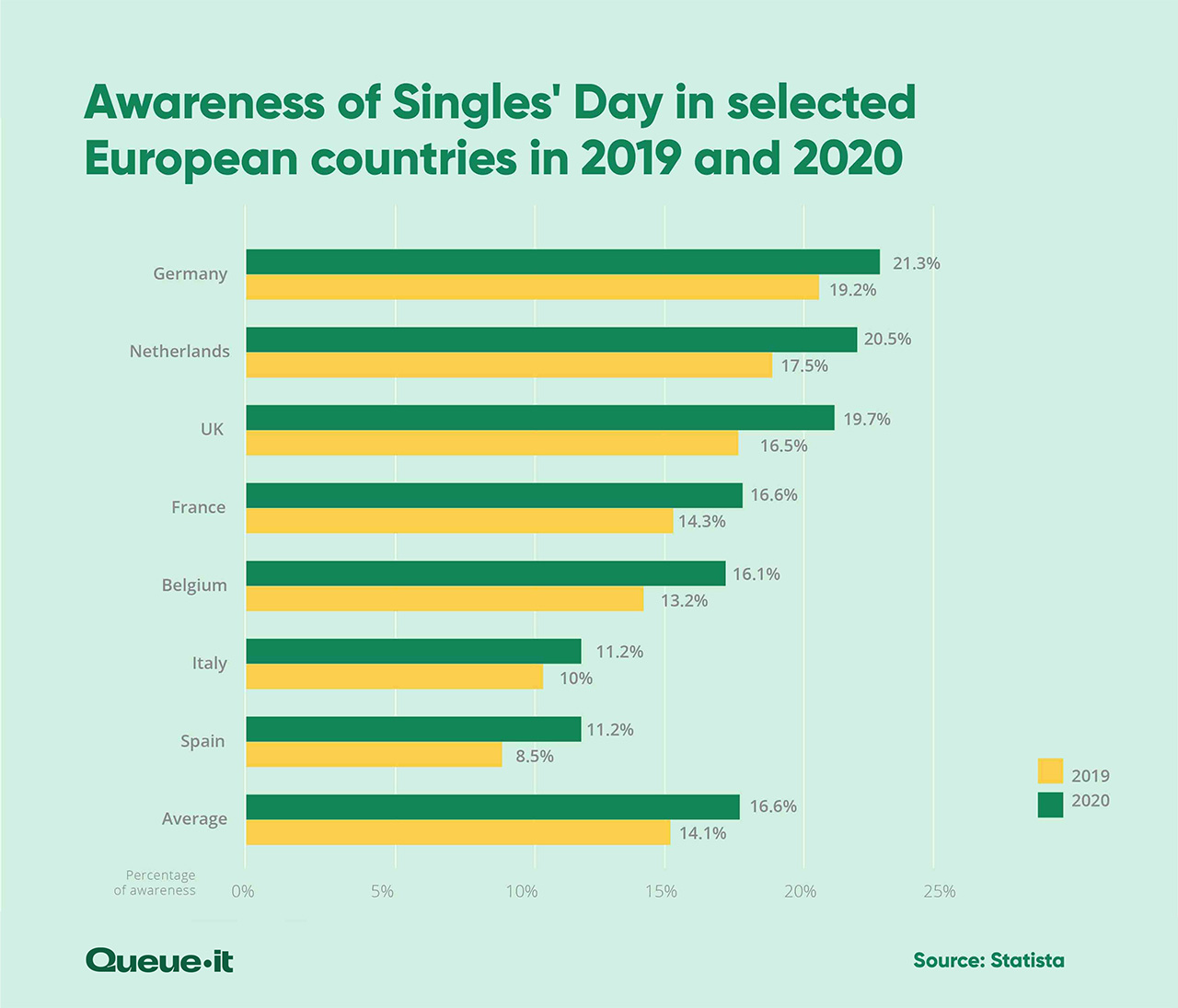

Is there potential for Singles’ Day shopping celebrations to be incorporated into Holiday Season sales outside Asia?

Many signs point to yes.

More and more European ecommerce companies are merging Singles’ Day into their end of the year sales, both in China and in their home markets.

100. At least 100 Western brands offered U.S. Singles’ Day sales in 2022—from direct-to-consumer sheets seller Brooklinen to luxury department store Saks Fifth Avenue and from boutique jewelry brand Kinn to clothing retail chain Ann Taylor.

101. Although not the size of Cyber 5 sales, Singles’ Day made its mark in Europe in 2021. Sales on 11.11 were up 80% in Italy, 68% in Spain, and 57% in France, compared to an average from the last week of October.

102. The top five foreign countries selling to Chinese consumers through cross-border platforms were Japan, the United States, South Korea, Australia, and Germany.

103. Over 29,000 overseas brands participated in 11.11 in 2021, offering over 1.3 million products via Alibaba’s Tmall Global.

104. In 2020, U.S. businesses made over $5 billion in sales on Singles’ Day, the most of any country outside of China.

105. Awareness of Singles’ Day is on the rise in many European countries:

106. The German-based Media Markt, one of Europe’s largest consumer electronics retailers now promotes Singles’ Day at their stores. They ensure their discounts are “nicht nur für Singles” (not just for Singles).

107. The biggest Dutch ecommerce site, bol.com, began participating in Singles’ Day in 2017, which proved to be the year’s busiest Saturday. In 2020, the business expanded their Singles’ Day sales into a three-day event.

108. A Vogue article on Singles’ Day says Western brands Luisa Via Roma, Verishop, and By Far, run major Singles’ Day sales in Europe and the U.S.

109. In Switzerland, many of the biggest online retailers have incorporated the day into their holiday sales.

Singles’ Day shatters sales records and draws in more shoppers every year. And the steady growth of ecommerce, mcommerce, and the Asia-Pacific market is only projected to continue.

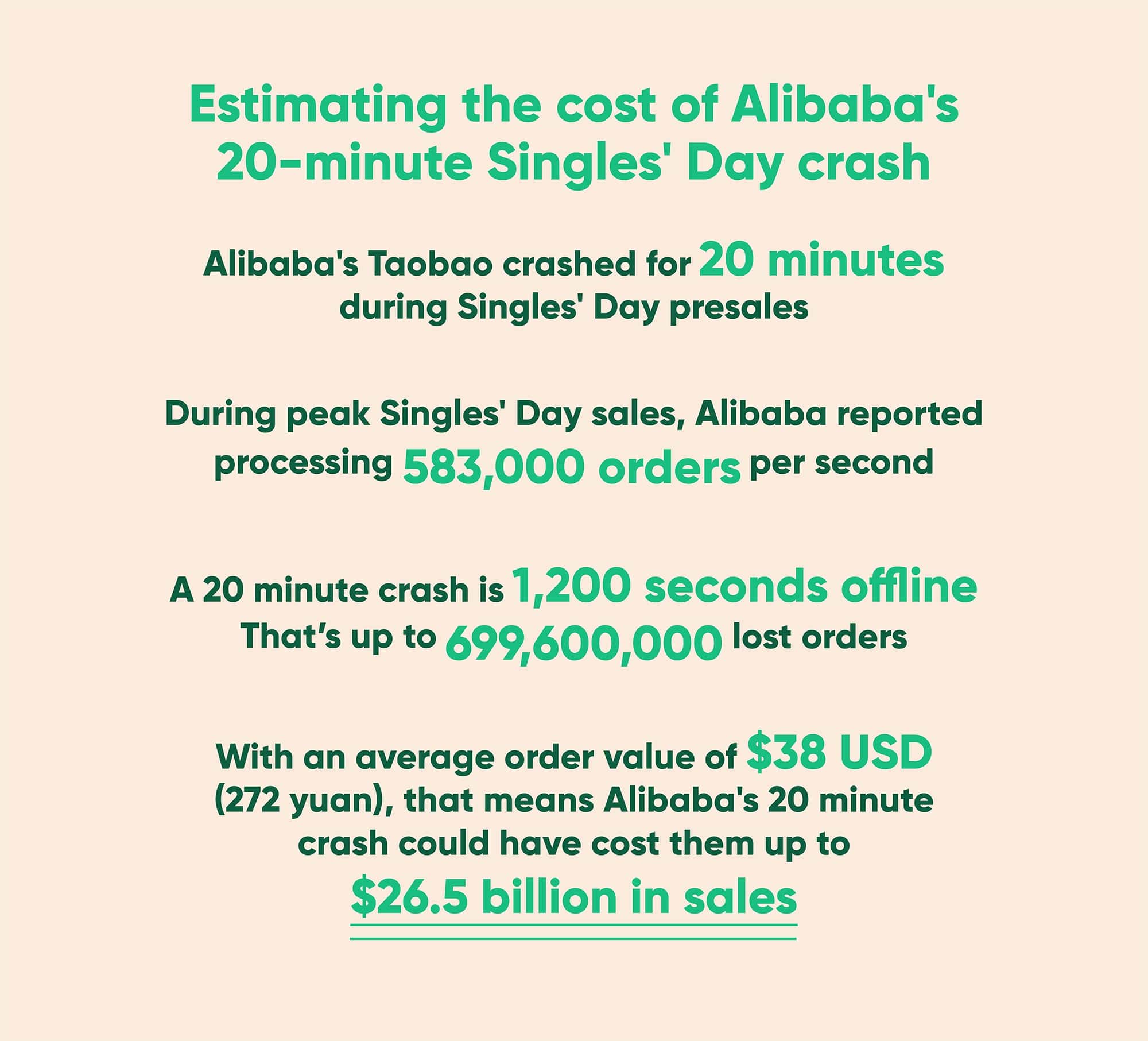

But more traffic brings with it more website slowdowns and crashes.

In 2021, Chinese shoppers flocked to the first Singles’ Day livestream pre-order event, crashing Taobao for 20 minutes.

The hashtag “Taobao crashed” was the number two trending topic on Wiebo, China’s version of Twitter. The topic thread had almost 18,000 comments, with many users complaining about missing out on deals and not finishing their orders.

The costs of website crashes add up fast, both for reputation and revenue.

In 2020, Alibaba reported up to 583,000 orders per second during peak periods.

A 20-minute crash is 1,200 seconds offline.

That’s up to 699,600,000 (almost 700 million) lost orders.

With an average order value of $38 USD (272 yuan), that means Alibaba's 20 minute crash could have cost them up to $26.5 billion in sales.

Related: The Cost of Downtime: IT Outages, Brownouts, and Your Bottom Line

This isn’t the first year Singles’ Day has crashed sites. In 2018 the ecommerce website Momo also saw traffic reach a new high with over 700 million transactions. At one point, the website crashed for 20 minutes because of traffic overload.

On the year’s biggest ecommerce shopping day, even a minute of website downtime can result in staggering sales losses. Even minimal slowdown or downtime can have a lasting effect on brand reputation.

With billions on the line, are you doing what it takes to safeguard your website?